Need Woodworkers? Study Finds You’re Not Alone

February 2022

A new study of the U.S. and Canadian woodworking industry conducted by Woodworking Network and the Woodwork Career Alliance of North America reveals that the production worker shortage continues to increase at an alarming rate with no clear end in sight.

A new study of the U.S. and Canadian woodworking industry conducted by Woodworking Network and the Woodwork Career Alliance of North America reveals that the production worker shortage continues to increase at an alarming rate with no clear end in sight.

Among the study’s highlights:

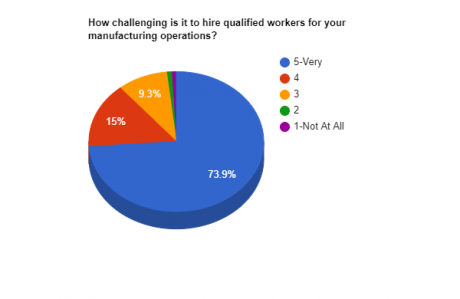

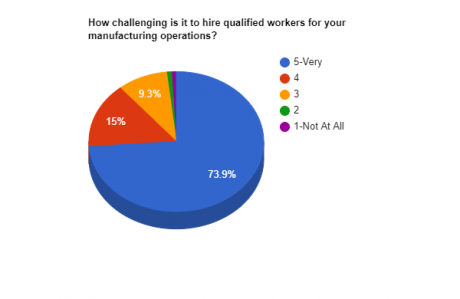

- 73.8% of the woodworking representatives participating in the survey indicated it is “very challenging” to hire qualified workers for their manufacturing operations. In addition, 57.9% said it has been “much more challenging” to hire now than three years ago.

- 39.3% of the respondents said their operations lost at least one-quarter of their production workforce during 2020, including 4.7% who experienced a turnover rate of more than 75%.

- 35.6% of the respondents said that their company’s failure to achieve full, stable employment has had a huge impact on their ability to increase revenues. An additional 38.4% indicated that staffing issues have curtailed their revenue potential.

What Makes Synergy Thermal Foils Stand Out?

February 2022

From our headquarters in South Florida, we scour the globe to find the best decorative surface films at the best possible price. We are driven to offer our customers high-quality products that are not only durable but are also defect-free and fashionable.

Some of the noteworthy things that distinguish our products in the world of thermofoils include:

- Our PVC is made by one of the world’s largest producers.

- No plasticizer content is used in our films.

- A protective UV-cured topcoat enhances the decorative design.

- UV stabilizers extend the life of our base films.

- Our products offer high mar and scratch resistance.

- We offer 1DL, 2DL, 3DL and PET options. Our 3DL collection provides matches of designs created by leading producers of TFL and HPL and are available in a wide range of textures.

- Our thermofoils can be flat-laminated, post-formed, membrane-pressed, miter-folded and profile-wrapped for residential and commercial cabinets, furniture, store fixtures and much more.

The more than 135 designs featured on our website is only a small fraction of the thousands of choices we offer globally. Contact us if you don’t see what you are looking for. We can custom create new designs or color matching designs in various material thicknesses, textures, and coating options for OEM customers.

Contact us to find the right decorative surface for your products or projects.

Featured Designs: Skye & Elmwood

February 2022

Skye

Two of our most popular designs – Skye and Elmwood – have been part of the Synergy Thermal Foils catalog for several years. Each of these luxuriously brushed elm decorative overlays spotlights the natural cathedrals and straight grains of the wood pattern. Our Skye matches Uniboard’s Skye TFL and our Elmwood matches Uniboard’s Driftwood TFL.

Elmwood

Skye and Elmwood can each be flat-laminated, post-formed, membrane-pressed, miter-folded, and profile wrapped for use in commercial and residential furniture, store fixtures, kitchen cabinets, closet systems, and much more.

Featured Design: Oatfield

January 2022

Our new Oatfield 3DL design is easy on the eye and evokes an airy calmness. Oatfield’s design versatility makes it well suited for country or urban environments.

Find a match with Kronospan K448 Oatfield TFL or Tafisa L546 Mojave TFL.

Our Oatfield product can be flat-laminated, post-formed, membrane-pressed, miter-folded and profile wrapped for use in commercial and residential furniture, store fixtures, kitchen cabinets, closet systems and much more.

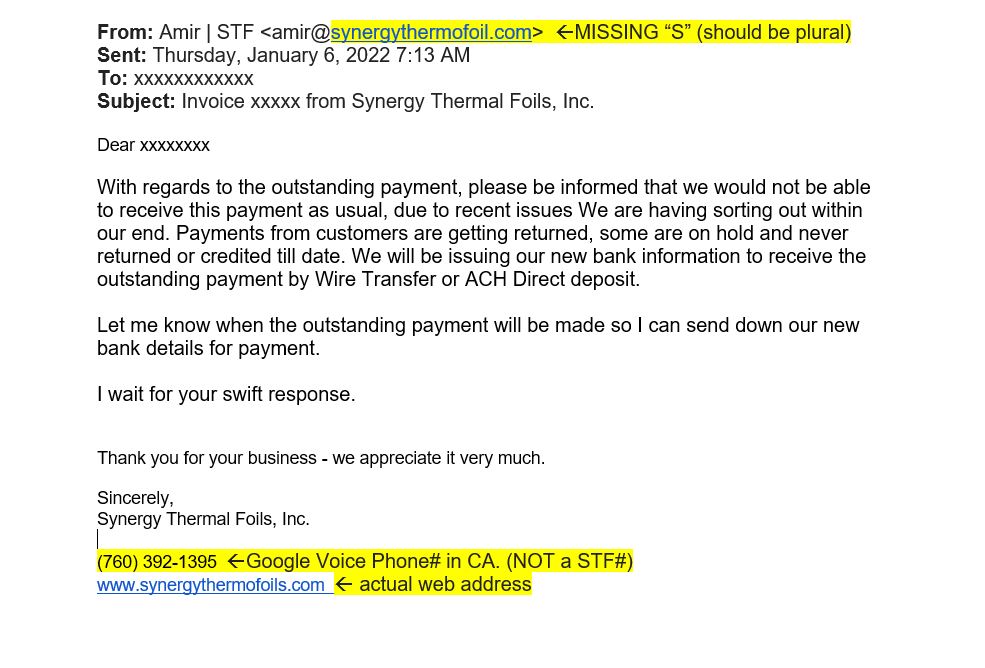

Scam Alert: Beware of Fraudulent Invoices

January 2022

January 7, 2022

Dear Valued Customer,

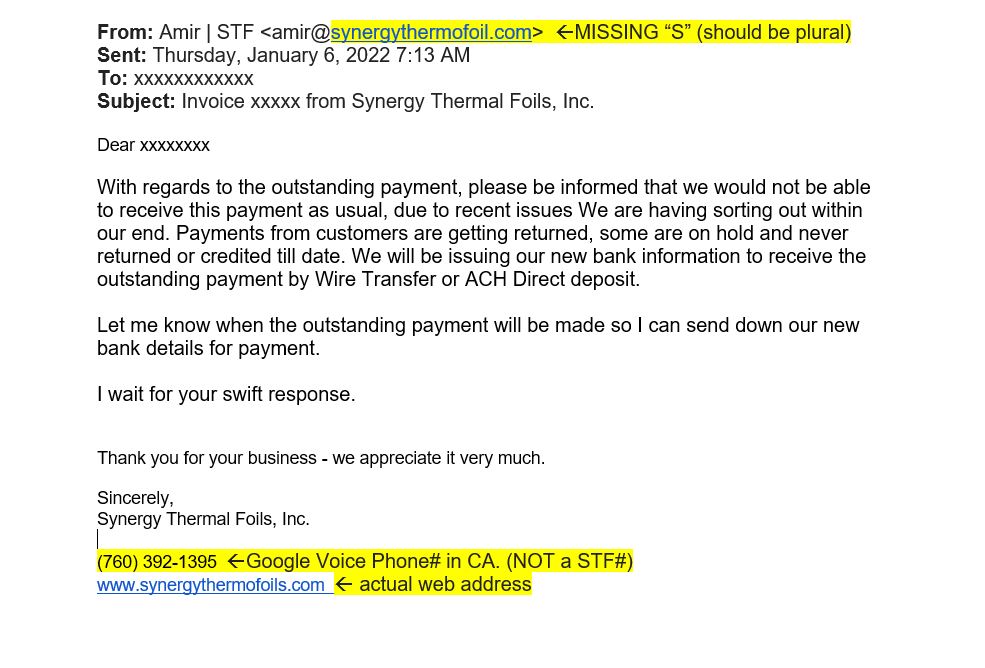

We just received a report from one of our customers alerting us that they had received a fraudulent invoice bearing Synergy Thermal Foils’ name, address and logo.

While we have only received one such report, we want to make sure that you are aware of this situation. Please let us know immediately if you have received similar correspondence to the one shown below. We are working with various authorities to investigate this matter.

This is the email that our customer received. It included an invoice attachment. We have x’d out the customer’s information and highlighted some of the contact information to be aware of.

We are grateful that our customer brought this to our immediate attention and are hopeful that this fraud attempt is a one-off and not more widespread.

While we are in the process of determining if the data breach was on our end or our customer’s, we think it is important that we all take note that hacking happens.

In this case, while the cover letter is poorly worded and includes several grammatical errors, it shows the great extent hackers will go to pull off their scam. Here’s a few things we have learned so far.

1. The perpetrators purchased the domain synergythermofoil.com and created an email almost identical to STF. Note that our web address and the email are synergythermofoils.com, plural.

2. The email includes a phone number with a California area code. Everyone who does business with us knows that we are based in South Florida.

3. The perpetrators set up an account with Chase Bank and instructed our customer to send payment there. We have not changed our bank account. We have the same banking information today as in 2010.

Thank you again for your business and trust. Please contact us directly if you suspect you have received a fraudulent STF invoice OR any request to change bank accounts for payments to us.

Please call us with any questions about payment status or to confirm any changes.

Synergy Thermal Foils

954-420-9553

Houzz Predicts Top Kitchen Design Trends for 2022

December 2021

Houzz.com recently released its 2022 forecast of top home design trends.

The trends of greatest interest to cabinet makers and kitchen remodelers include:

A casual collected look: While the 2021 U.S. Houzz Kitchen Trends Study confirmed that all-white kitchens remain dominant, layered looks are gaining in popularity. A more casual, less-polished approach with softer paint colors, raw wood tones, and a mix of cabinet fronts and styles is predicted to rise.

Long and linear backsplash tile: White subway tile is a classic look for a kitchen backsplash, but many homeowners are searching for a modern twist on the material. White ceramic 4-by-12-inch tile lends a timeless feel while its elongated form gives it a fresh, updated appearance.

Hardworking storage: While the general function of cabinetry hasn’t changed much over the years, the inside of cabinets has dramatically shifted. Pullouts bring pantry items from the back of cabinets to the front, special shelves lift heavy appliances from a lower cabinet to countertop height, and drawer dividers organize plates and bowls.

Multiple window banks: Thanks to the rise of hardworking pantry walls, storage-optimized island bases, and lower cabinets that allow homeowners to skip upper cabinets, Houzz pros anticipate homeowners to go with expansive runs of windows in 2022.

The Oak Celebration Concludes with Charleston

December 2021

In each of the last three issues of On The Surface we have featured one of the designs in our new Oak collection. This month, we conclude our salute to the mighty oak, America’s national tree, with

Charleston.

All four of the new oak introductions can be flat-laminated, post-formed, membrane-pressed, miter-folded and profile wrapped for use in commercial and residential furniture, store fixtures, kitchen cabinets, closet systems and much more.

Own a Home Just Like Elon Musk’s for Under $50,000

November 2021

Rumor has it that Elon Musk took up residence in a 375-square-foot pre-fabricated home after he bolted from California to Texas.

Not only has the tiny home’s maker, Boxabl eluded to Musk being a customer, the billionaire of Tesla and SpaceX fame, tweeted that he was indeed living (as least temporarily) in one of the home’s on SpaceX’s campus in Boca Chica, Texas.

Looks like Musk is once again ahead of the curve. Las Vegas-based Boxabl reportedly has a wait list numbering tens of thousands of customers for its prefab homes that sell for $49,500. The houses ship flat pack and assemble in less than a day.

Check out this video to see a Boxabl home set up and take a tour of its interior.

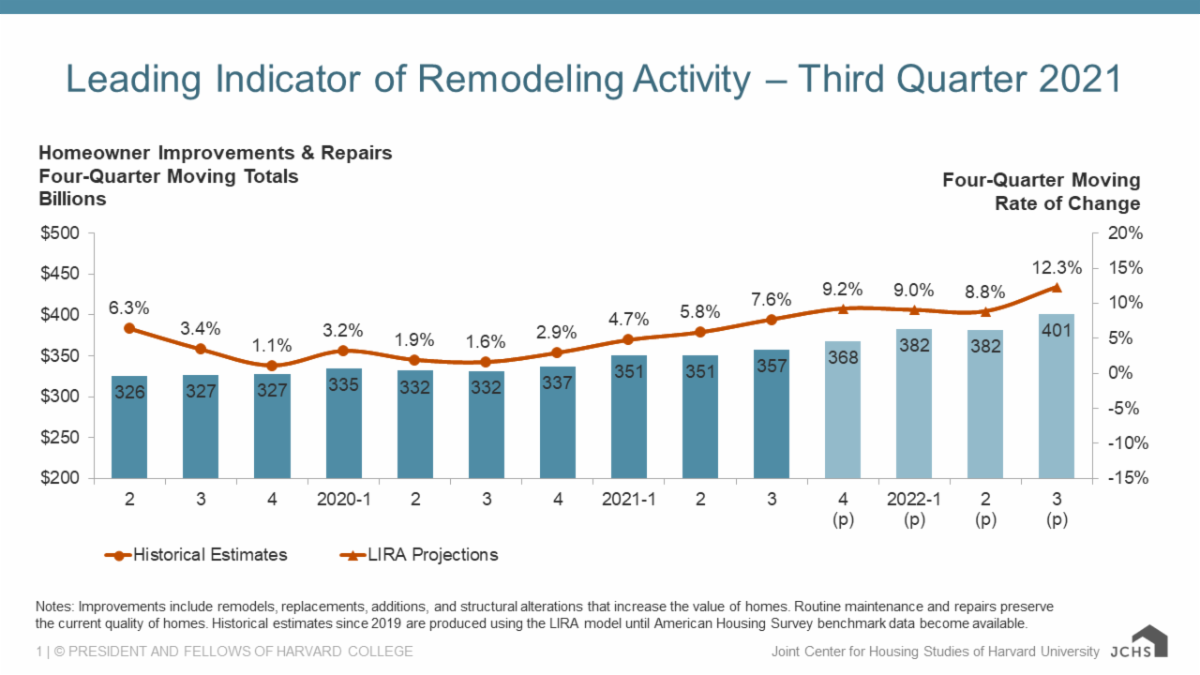

Robust Remodeling Market to Keep on Keepin’ on

November 2021

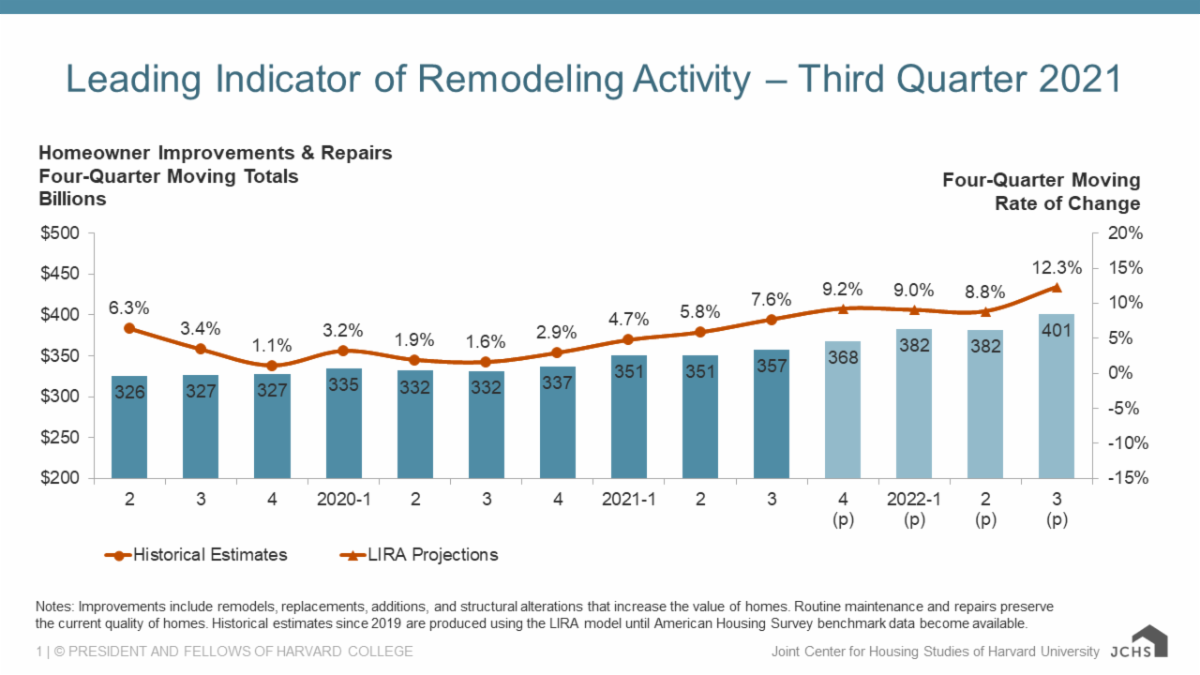

Strong growth in home improvement and maintenance expenditures is expected to continue over the coming year, according to the Leading Indicator of Remodeling Activity (LIRA) released by the Remodeling Future Program at the Joint Center for Housing Studies of Harvard University.

The LIRA projects year-over-year gains in annual improvement and repair spending will reach 9 percent in the fourth quarter and maintain that pace into 2022.

“Residential remodeling continues to benefit from a strong housing market with elevated home construction and sales activity and immense house price appreciation in markets across the country,” said Carlos Martín, project director of the Remodeling Futures Program at the Center. “The rapid expansion of owners’ equity is likely to fuel demand for more and larger remodeling projects into next year.”

“With these tailwinds, annual improvement and repair expenditures by homeowners could reach $400 billion by the third quarter of 2022,” said Abbe Will, Associate Project Director of the Remodeling Futures Program. “Yet there are several headwinds that could still taper the expected growth in remodeling spending including the rising costs of labor and building materials, as well as increasing interest rates.”

The Celebration Continues with Williamsburg Oak

November 2021

In 2004, the mighty oak was selected as America’s tree in a nationwide vote organized by the National Arbor Day Foundation. Oak bested redwood 101,000 to 81,000. Dogwood, maple and pine rounded out the top five trees receiving the most votes cast by citizens of all ages.

Oak is the most widespread of hardwoods with more than 60 species growing in the United States. Oak is prized for its strength, beauty and furniture-grade lumber. Due to its endearing and enduring qualities, it’s little wonder that oak is also the official tree of six states: Connecticut, Georgia, Illinois, Iowa, Maryland and New Jersey.

Each of these textured RTFs can be flat-laminated, post-formed, membrane-pressed, miter-folded and profile wrapped for use in commercial and residential furniture, store fixtures, kitchen cabinets, closet systems and much more.

Carolina Oak: OAKtober Party Crasher

October 2021

Illinois is observing OAKtober, a month-long celebration of white oak, the official state tree.

In addition to the Land of Lincoln, variations of oak are the state trees of five other states including:

- Connecticut, Charter oak;

- Georgia, lively oak;

- Iowa, bur oak;

- Maryland, white oak; and

- New Jersey, northern red oak.

Synergy Thermal Foils crashes the party with Carolina Oak, a new textured RTF destined to become a favorite for furniture and cabinets. Carolina Oak is one of four oak designs that we are introducing, the others being Highlands Oak, Charleston, and Williamsburg. Each of these new oak designs has a TFL match with Funder America.

All of our new products can be flat-laminated, post-formed, membrane-pressed, miter-folded, and profile wrapped for use in commercial and residential furniture, store fixtures, kitchen cabinets, closet systems, and much more.

Online Tour Explores Eggers’ $500 Million Mill

October 2021

Egger Wood Products, one of our Matching Program partners, offers a “virtual tour” of its $500 million manufacturing plant in Lexington, NC, that began operating last fall.

.

The tour features 13 segments, each focusing on a different area of the 1-million-square-foot facility spanning from the woodyard through the design center. In between our highlights of the plant’s automated systems for manufacturing particleboard and thermally-fused laminate.

A new study of the U.S. and Canadian woodworking industry conducted by Woodworking Network and the Woodwork Career Alliance of North America reveals that the production worker shortage continues to increase at an alarming rate with no clear end in sight.

A new study of the U.S. and Canadian woodworking industry conducted by Woodworking Network and the Woodwork Career Alliance of North America reveals that the production worker shortage continues to increase at an alarming rate with no clear end in sight.

In each of the last three issues of On The Surface we have featured one of the designs in our new Oak collection. This month, we conclude our salute to the mighty oak, America’s national tree, with

In each of the last three issues of On The Surface we have featured one of the designs in our new Oak collection. This month, we conclude our salute to the mighty oak, America’s national tree, with  Strong growth in home improvement and maintenance expenditures is expected to continue over the coming year, according to the Leading Indicator of Remodeling Activity (LIRA) released by the Remodeling Future Program at the Joint Center for Housing Studies of Harvard University.

Strong growth in home improvement and maintenance expenditures is expected to continue over the coming year, according to the Leading Indicator of Remodeling Activity (LIRA) released by the Remodeling Future Program at the Joint Center for Housing Studies of Harvard University. In 2004, the mighty oak was selected as America’s tree in a nationwide vote organized by the National Arbor Day Foundation. Oak bested redwood 101,000 to 81,000. Dogwood, maple and pine rounded out the top five trees receiving the most votes cast by citizens of all ages.

In 2004, the mighty oak was selected as America’s tree in a nationwide vote organized by the National Arbor Day Foundation. Oak bested redwood 101,000 to 81,000. Dogwood, maple and pine rounded out the top five trees receiving the most votes cast by citizens of all ages.