Employment and Wages Catching Up with a Roaring U.S. Economy

September 2018

Without a shadow of a doubt, the U.S. economy has been on a rampage in recent months. Growing beyond expectations within multiple economic indicators. Effects of the booming economy are being felt by every person from the average worker to the largest corporations.

Second quarter GDP has been reported at 4.2% at an annualized rate; almost double the Q1 reports. GDP growth has been largely attributed to larger consumer spending and an increase in soy exports for the second quarter. This is the strongest growth rate since Q3 of 2014.

Private domestic business investment has been steadily on the rise following the 2017 tax plan implemented, reaching nearly $596 billion for Q2. Investment as a percentage of the economy is at about the same level of the mid-2000’s boom.

Consumer confidence is on the rise as well, up 5.5 points in August according to the Conference Board. The index now stands at 133.4 (1985 = 100), up from 127.9 in July. The present situation index improved from 166.1 To 172.2 and the expectations index also increased from 102.4 last month to 107.6 this month.

“Consumer confidence increased to its highest level since October 2000 (Index, 135.8), following a modest improvement in July,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of current business and labor market conditions improved further. Expectations, which had declined in June and July, bounced back in August and continue to suggest solid economic growth for the remainder of 2018. Overall, these historically high confidence levels should continue to support healthy consumer spending in the near-term.”

Unemployment remains at historically low levels for August, unchanged at 3.9%. Nonfarm payroll employment increased by 201,000. Job gains occurred in professional and business services, health care, wholesale trade, transportation and warehousing and mining. A broader measure of unemployment that includes individuals who are unemployed but have given up looking for work fell to 7.4 %, the lowest level since April 2001.

With many indicators pointing towards a rocking economy, one thing has remained a drag on growth; wages. That is starting to change. Average hourly earnings have increased 0.4% in August following a 0.3% increase in July. This has raised annual increases in wages to 2.9%, the largest increase since July 2009. However, this has matched the current rate of inflation (compared to previous months where the rate of inflation outpaced wage growth). If the inflation rate remains steady finishing out Q3 and going into Q4, wage growth is likely to surpass that by the end of 2018.

Cabinet Sales Increase Year Over Year

September 2018

July has reported an increase in cabinet sales of 3.8% for July over the same time frame during 2017 according to the Kitchen Cabinet Manufactures Association (KCMA)’s monthly Trend of Business Survey. Participating cabinet manufactures have notated that stock sales has increased by 9.2%, custom sales increased 8.4%, however semi-custom sales decreased 3.1% year over year.

Year to date cabinetry sales through July 2018 are up 1.5%, stock sales are up 3.2%, semi-custom decreased 1.1% and custom sales are up 3.9% so far this year.

Survey participants include stock, semi-custom, and custom companies – companies that belong to KCMA represent combined sales of approximately 70% of the U.S. kitchen cabinet and bath vanity market.

U.S. Furniture Sales Up 5%

September 2018

In tune with other manufacturing markets, U.S. furniture manufacturers have reported a 5% increase in sales during July 2018 over the previous month. From the recent survey of residential furniture manufacturers and distributors completed by Smith and Leonard, this 5% increase has been a consistent trend over the past couple of months. June experienced a 5% increase over May and May experienced a 15% increase over April. Year to date, orders are up 6% over 2017 with over 60% of participants reporting increased orders.

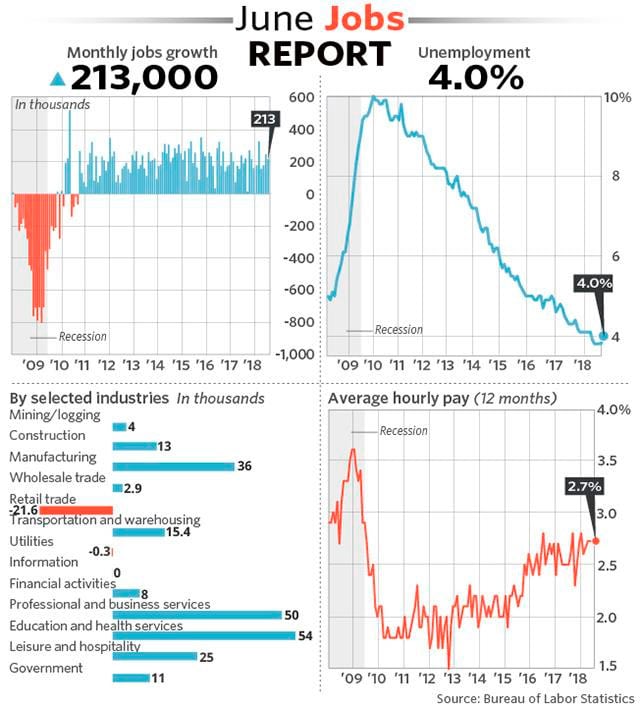

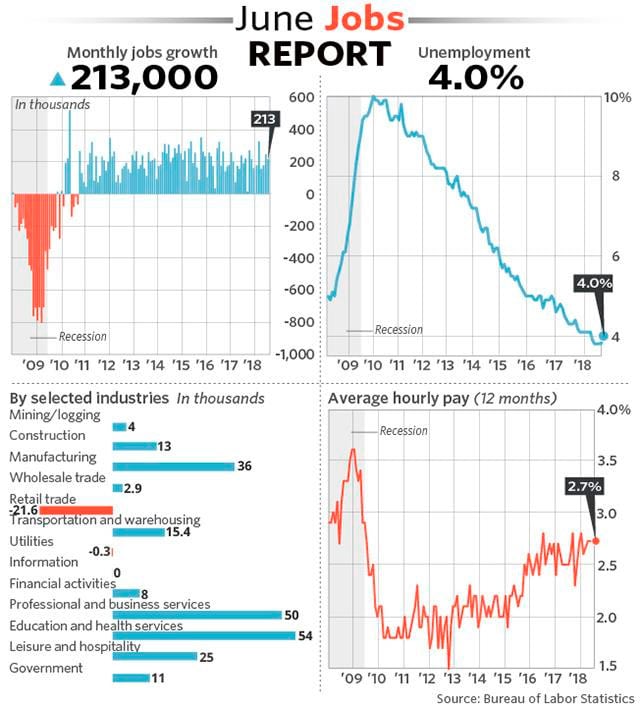

U.S. Hiring Continues to Grow Despite Unemployment Rate Increase

July 2018

As our robust economy continues to ramp up, employers added 213 non-farm jobs to the payroll in June according to the Labor Department. Despite original forecasts of 200,000 by economists, unemployment rate crept up to 4%, up from 3.8% in May.

While the unemployment slightly increased it was largely due to an influx of eligible workers added to the labor market. Recent graduates, parents or others previously frustrated by their prospects have entered or reentered the labor force causing the labor force to grow an average of 250,000 workers each month this year. In June, the share of American adults working or looking for a job rose 0.2% to 62.9%.

The shrinking pool of labor is slowly forcing companies to raise pay as the competition for talent intensifies, but they are still managing to keep labor costs down. Hourly wages rose a modest $0.05 to $26.98. The yearly rate of pay increases was unchanged at 2.7%, sitting slightly lower than the current rate of inflation which reached 2.9% in June.

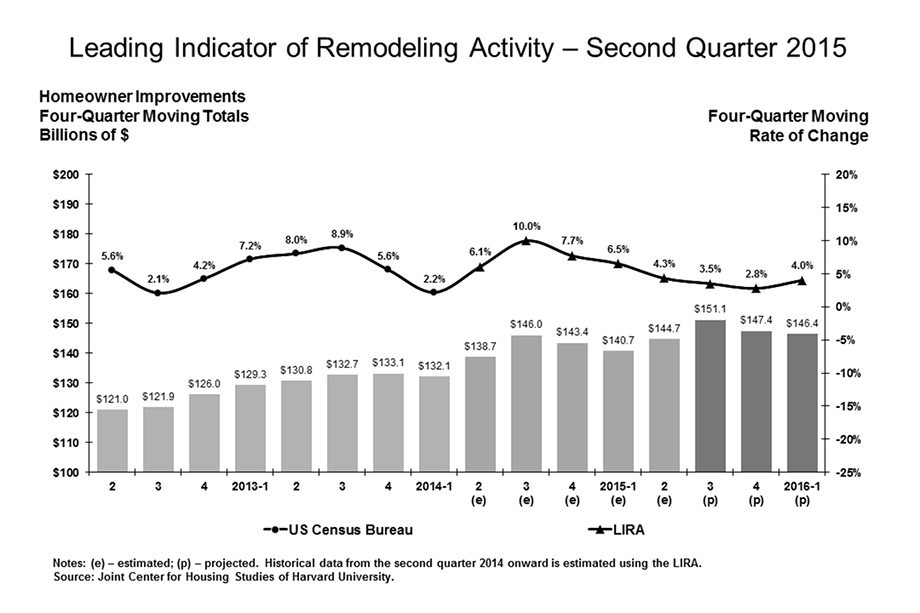

The State of U.S. Housing (A Series)

June 2018

Part 3: Home Prices and Rent Growth

Over the past couple of months, STF has released a series of articles analyzing the U.S. housing market called “The State of U.S. Housing”. Part 1 focused on too many buyers and not enough homes. Part 2 took a look at high construction costs and public policy that hinders new construction. This month will dive deeper into home prices and the impact stagnant wage growth has had on the market.

The lack of new housing supply has been the driving force behind home values. On the national level, home prices have regained most or all of the ground lost during the recession. Home prices have risen year over year an average between 5% and 7% in the last 5 years, 2018 first quarter saw an increase of 6.9% over the same time period in 2017. While an increase in home price is fantastic news to the seller, for many buyers including first time home buyers, they are being priced out of the market. Heavy demand has led to massive bidding wars and many people have resorted to paying above asking price.

With a robust economy many economist assumed wages would rise naturally, however that has not been the case for many employees. Growth in average hourly earnings has had mediocre increases year over year averaging between 2.5% and 2.7% yearly since 2010. This increase in wages are slightly higher than the yearly rate of inflation which has remained steady at 2.2% for the past 5 years.

Not only has wage growth been stagnant but increases in average monthly rent have actually surpassed inflation. According to Zillow and the Zillow Rent Index (ZRI) rent growth has increased 2.5% annually. This along with the stagnant wage growth indicates that people have not been able to increase savings or have had to decrease savings for general living costs. For many first time home buyers, this has been the hurdle they are trying to overcome, the inability to save or increase savings for higher priced homes has shut the door on the dream of home ownership.

Unemployment Lowest in Nearly Two Decades

June 2018

The U.S. labor market has surpassed expectations yet again, according to the U.S. Labor Department non-farm payroll added 223,000 jobs in May.

The increase in job openings has further pushed the unemployment figure down to 3.8%, the lowest in it has been since 2000. The labor department is now reporting that there are more job openings in the U.S. than people to fill them, there is an estimated 6.7 million job openings at the end of April with an estimated 6.3 million unemployed.

While the unemployment figure is indicative of a roaring economy, some employers are beginning to feel the strain. A tight labor pool has made it increasingly difficult for employers to fill open positions with adequate candidates. Many employers are facing a pool of unqualified people to work and in turn have begun to increase wages and incentives to attract more qualified individuals.

The State of U.S. Housing

May 2018

Part 2: Higher Costs and Public Policy

STF will be releasing a series of articles analyzing the U.S. housing market called “The State of US Housing”. The importance of the real estate sector on the U.S. economy cannot be overstated. More than half of the private wealth in the U.S. is composed of real estate assets, with $25 trillion in residential and $15 trillion in commercial. Even modest changes in the market can have massive ramifications in the U.S and globally as the world experienced following the bubble burst in 2009. So each month we will dive into various factors that are driving the current housing market.

Last month’s issue of The State of U.S. Housing focused on the effects of low supply and high demand. A robust economy has provided many Americans the opportunity to purchase a home, however with low construction rates and a high demand many are experiencing difficulties in purchasing a home.

This month will focus on the constraints that are limiting supply growth in the housing market, more specifically into construction costs and the impact of housing policies.

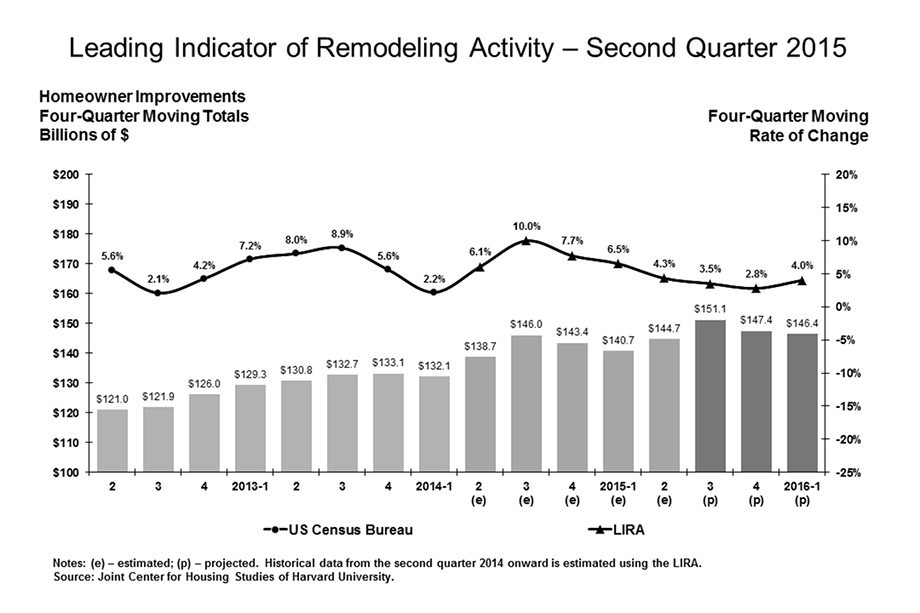

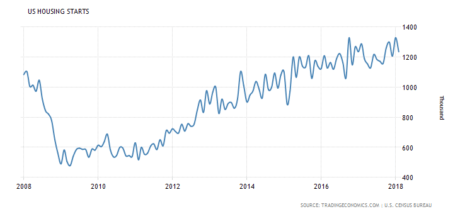

Housing starts rose 1.9% in March to a seasonally adjusted annual rate of 1.319 million units according to the Commerce Department. Despite the rebound in homebuilding last month, activity appears to be slowing. Single-family homebuilding, which accounts for the largest share of the housing market, fell 3.7% to a rate of 867,000 units in March.

New residential construction has remained at historically low levels following the 2008-2009 bubble burst. On a population-adjusted basis, housing starts averaged the equivalent of 2.5 million units per year from 1960 through 2005. From 2006 through February 2018, starts have averaged the current equivalent of just 1.1 million units per year, where 1.3 million units per year is required to maintain a balance in the population growth.

One of the biggest constraints facing new construction is the large increase in construction costs over the past 10 years. Annual inflation rates in the U.S. has averaged 2.2% over the past 25 years, according to the Bureau of Labor Statistics, close to the Federal Reserve’s goal of 2%. However, construction cost inflation has nearly doubled the pace of the annual, reaching an average of 4% per year, with costs of goods already reaching 4% increase during the first 4 months of 2018. The graph below indicates the change in costs for goods in residential construction based on the Producer Price Index (PPI) released by the Bureau of Labor Statistics.

Not only are builders facing higher costs but recent policies enacted by the current administration has started to drive building costs even higher. Tariffs placed on Canadian lumber and other imported products are pushing up prices and hurting housing affordability.

The need for entry level homes is at an all-time high with the large influx in demand for homes coming from the millennial generation. However, increases in costs have dwindled a builder’s desire for completing entry level homes. Instead most builders are focusing on mid-range and higher homes due to larger margins.

The next major limitation on new housing construction comes from public policy on housing such as land-use zoning and affordable housing policies. State and local governments limit land development based on zoning policies, this in turn makes it more difficult for developers to find suitable lots to build on.

Additionally, “Not in my backyard” groups (NIMBY) have started to have major influence on new land development through community outreach and action. Neighborhoods in Seattle don’t want apartments for homeless seniors; in Los Angeles, they don’t want more high rises; in San Jose, CA they don’t want tiny homes and the list goes on and on. All these are types of housing that could help alleviate some immediate housing issues, yet NIMBY groups oppose them at all costs. Worried that these new housing forms will not only hurt their home value but burden public services such as schools, roads and transportation, NIMBY groups continue to have an enormous impact on the development of housing.

Builder Confidence Back on the Rise

May 2018

Builder confidence for the market on newly-built single-family homes rose two points to a level of 70 in May according to the National Association of Home Builders/ Wells Fargo Housing Market Index (HMI).

This is the fourth time this year that the confidence levels have reached 70 or higher on the HMI index. Builders remain confident in new single-family homes by continued growing demand due to the inventory shortage many are seeing within the housing market.

While concerns over lack of land to build on and a shortage of skilled workers, a new issue has come to play in this month’s builder’s confidence: the increase in lumber prices. The increase in lumber prices are driving up costs making it more difficult for builders to produce competitively price houses for first time home buyers.

Derived from a monthly survey, the NAHB/ Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months. Scores for each component are used to calculate a seasonally adjusted index where any number over 50 indicates that more builder view conditions as good than poor.

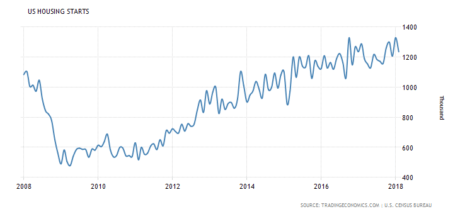

The State of U.S. Housing

April 2018

Part 1: Too many Buyers and not enough Homes

Over the next few months, STF will be releasing a series of articles analyzing the U.S. housing market called “The State of US Housing”. The importance of the real estate sector on the U.S. economy cannot be overstated. More than half of the private wealth in the U.S. is composed of real estate assets, with $25 trillion in residential assets and $15 trillion in commercial assets. Even modest changes in the market can have massive ramifications in the U.S. and globally, as the world experienced following the bubble burst in 2009. So each month we will dive into various factors that are driving the current housing market.

This month’s focus will be on one of the biggest factors impacting today’s market: too many buyers and not enough homes.

As the tail end of the millennial generation is now entering adulthood the “American Dream” of homeownership seems to be a very problematic dream to achieve. Weighed down by the largest student debt ever seen, with 42.3 million borrowers owing a total of $1.3 billion in Federal student debt (does not include private student financing), many millennials have put off venturing into homeownership. With below average paying jobs, skyrocketing rents (especially in metropolitan areas) and the heavy burden of student debt, it has been impossible for many to save up to purchase a home up to this point. However, an expanding economy has spurred job and salary growth that has, in turn, lead to a push for homeownership.

Existing Home Sales, Month’s Supply: Previous 5 years

What many people are discovering is that finding a home (and getting it) is now more difficult than financing the home itself. A severe shortage of affordable entry-level homes has made it impossible for many buyers. February 2018 recorded an inventory level at 3.4 months, barring any additional homes going on sale the market only has enough homes for 3.4 months of sales based on current market conditions. This is one of the lowest inventory supplies on record. According to the National Association of Realtors (NAR), a healthy housing market has a 6-month supply. The number of starter homes is down 14.2% in the first quarter from a year ago, according to Trulia.

While the sale of existing homes has been tight, there has been little done to alleviate the pressure with new construction. Builders are grappling with construction worker shortages, soaring raw material costs and limited land availability and cumbersome regulations. Single-family housing starts were up 2.9% in February over January, a small jump but nowhere near enough to cover the current demand.

Despite more than doubling off the bottom at the depths of the financial crisis (581,000 single-family housing starts in December 2009 to 1,236,000 in February 2018), the rate of annual housing starts remains low on a historical basis. On a population-adjusted basis, housing starts averaged the equivalent of 2.5 million units per year from 1960 through 2005. From 2006 through February 2018, starts have averaged the current equivalent of just 1.1 million units per year.

The rate of growth in housing starts has been declining linearly since peaking at 28% in 2012, growing just 3% in 2017. Housing starts are expected to increase by 0 to 5% in 2018. The overall trend remains weak, however, as total starts rose just 1.98% over the past twelve months, the slowest rate of growth since 2011.

U.S. Housing Starts (Previous 10 years)

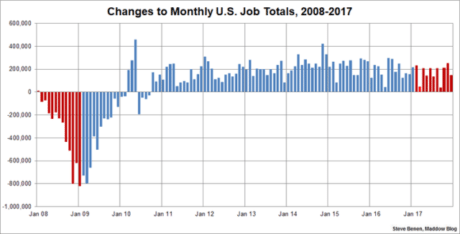

U.S. Jobless Claims Never Been So Low for So Long

April 2018

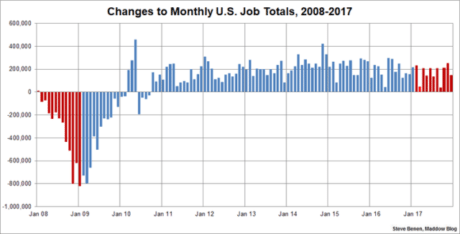

March marked the 90th consecutive month of job growth, by far the largest streak on record. While March only added 103,000 jobs, it has maintained the unemployment rate at 4.1%.

The slight slowdown in March wasn’t a surprise. February’s job growth was probably inflated by a surge in hiring in construction and the retail sector that reflected unseasonably warm weather in much of the country. Both sectors slumped in March as winter storms blew through the eastern United States.

Image: Political Wire

U.S. Adds 313,000 New Jobs in February

March 2018

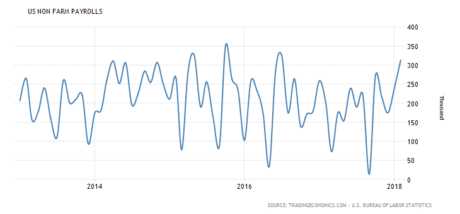

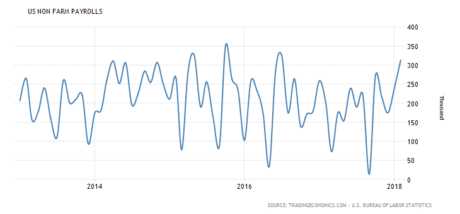

Non-farm payroll has increased yet again, surprising economists who predicted only a moderate increase in the jobs report for February. A hot labor market has shown no sign of cooling as the U.S. has added 313,000 jobs in February, the most since July 2016.

The portion of Americans over 16 working or looking for jobs increased from 62.7% to 63%, which has kept the unemployment rate unchanged at 4.1%, a 17-year low.

The unseasonably warm weather has allowed the construction segment to add 61,000 jobs, the most notable job gains. Followed closely by retail (50,000 positions), professional and business services (50,000 positions), and manufactures (31,000 positions).

US Non-Farm Payrolls

U.S. Economy: On the right track

February 2018

Consumers and business powered the economy to an estimated 2.6% growth in GDP during the fourth quarter of 2017. While this fell short of some economists original forecasts of 3% growth, overall during 2017 the economy grew 2.3%, compared to 2016 which only saw a 1.6% growth. This is the longest continued expansion of GDP on record.

Consumer spending accelerated to 3.8% annual pace of growth, the fastest it’s been in almost two years. Business also increased spending on equipment by 11.4% and investment in new housing jumped 11.6%.

The economy continues to hum along,” according to Ryan Sweet, an economist at Moody’s Analytics. “This is far from doom and gloom. Businesses are investing aggressively and consumers continue to spend at a very strong pace. We got a bit spoiled by 3 percent-plus growth in the last couple of quarters, but that streak was eventually going to come to an end.”

Recently passed tax cuts for individuals and business are expected to give the economy another major boost in 2018. The Atlanta Federal Reserve is already projecting a very robust first quarter of 2018, stating the U.S. economy is on track to grow at a 5.4% annualized rate.

Image courtesy of Global Business Outlook