On the Surface

January 2021

|

|||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||

|

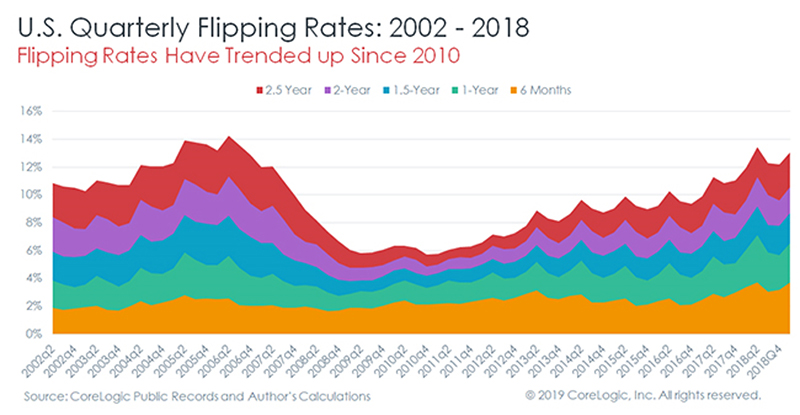

Home flipping is on the rise, nearly back to the same level it was around the peak of the housing bubble in 2006. However, this time around it does not cause concern for many economists as the flips are less risky.

According to a recent report from Core Logic Inc, that has been tracking house flipping data since 2002, stated that the flipping* rate has increased on a year over year basis for 12 consecutive quarters. 2018 fourth quarter flipping rate was at 10.9% of home sales, compared to first quarter of 2006 which was at 11.3%.

The biggest markets for house flipping falls mostly along the sun belt with Birmingham, AL at 16.5% followed by Memphis, TN (16.22%), Tampa, FL (15.1%), and Las Vegas, NV (15%). Other markets with high average rates are New Jersey, Arizona, Pennsylvania and Georgia.

At the low end of the home flipping rates areas such as Austin, TX (4.3%), Bridgeport, CT (4.4%), Hartford, CT (5.1%), and New Haven, CT (5.3%) along with other parts of Texas, Massachusetts, Illinois and Wisconsin.

This time around house flipping is more based on adding value and speculating on prices. Adding value to older homes is has been key to ensure there is no market volatilely. This allows entry level homes back to the market without large costs for first time home buyers (entry level homes are desperately needed on the market due to a lack of supply). One of the key takeaways from the housing bust was that a large part of the flipping industry was based on speculation on future home prices.

*House flipping rate is determined as a percentage of total home sales that have been owned for less than two years.

U.S. job openings fell in February to the lowest level in nearly a year. Seasonally adjusted, there was 7.09 million unfilled jobs in February, down by more than 500,000 from January.

While job openings may have fallen, unemployment rates have stayed at very low levels, for both February and March, the unemployment rate stayed at 3.8%.

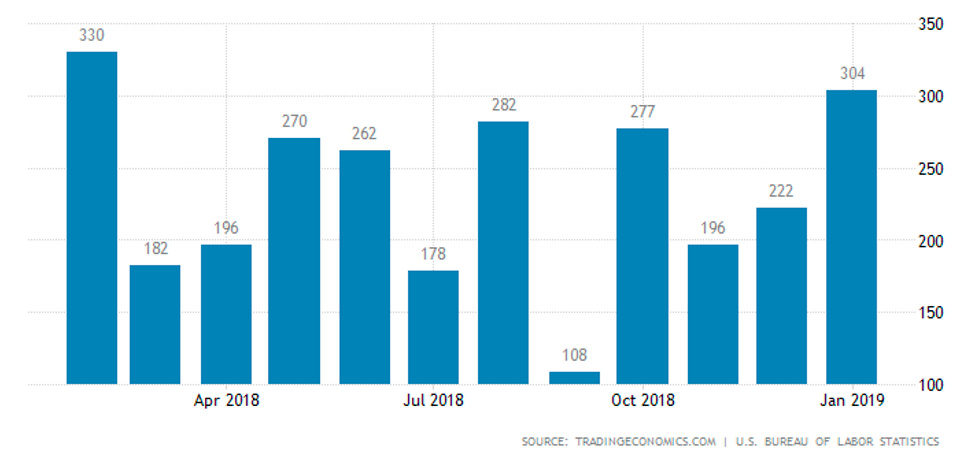

The U.S. labor market has reached a new record with the longest streak of job additions to the market. January marked the 100th month of consecutive job growth within the U.S according to the Bureau of Labor Statistics.

Nonfarm payrolls rose to a seasonally adjusted rate of 304,000 in January. Employment grew in several industries including leisure and hospitality, construction, health care and transportation and warehousing.

Unemployment ticked up to 4.0% but that is attributed to the partial government shutdown that lasted 35 days. Despite uncertainties that surrounded the partial shutdown, it did not slow down the private sector hiring.

Unemployment in September has hit the lowest level since 1969, with little to no indication it is going to go back up any time soon. The U.S. Labor Department has reported that unemployment is now at 3.7%, with the addition of 134,000 jobs in September.

Consumer confidence hit an 18 year high in September, a very positive indicator for spending going into the holiday shopping season. The Conference Board Index measured consumer confidence at 138.4, up from 134.7 in August. This is the highest it has been since September 2000. (An index reading of 100 represents how household saw the economy in 1985).

A high consumer confidence is a good sign for the third quarter GDP, since consumer spending attributes to about 70% of GDP and economist are forecasting GDP growth at 3.3% for the third quarter. While some economist have voiced concerns about current trade tensions between the U.S and our trading partners, the consumer has not felt the effect of it.

In the continuing trend of increasing confidence and outlook, the National Association of Manufacturers (across all industries) are reporting exceeding high (92.5% of respondents) outlook for the third quarter. This is on pace for the highest yearly reading of the surveys 20 year history. Outlook for the fourth quarter is at 93.9% positive, making it the highest one-year average on record. Optimism for small manufacturers increased in by 1.8% from Q2 to Q3 to 91.3%.

Builder confidence remains unchanged in September from August at 67 according to the National Association of Home Builders/Wells Fargo Housing Market Index. Builders remain confident that the growing economy and rising incomes will allow more individuals to pursue buying new homes. Even with housing affordability becoming a challenge, many builders maintain a positive outlook for September.

Without a shadow of a doubt, the U.S. economy has been on a rampage in recent months. Growing beyond expectations within multiple economic indicators. Effects of the booming economy are being felt by every person from the average worker to the largest corporations.

Second quarter GDP has been reported at 4.2% at an annualized rate; almost double the Q1 reports. GDP growth has been largely attributed to larger consumer spending and an increase in soy exports for the second quarter. This is the strongest growth rate since Q3 of 2014.

Private domestic business investment has been steadily on the rise following the 2017 tax plan implemented, reaching nearly $596 billion for Q2. Investment as a percentage of the economy is at about the same level of the mid-2000’s boom.

Consumer confidence is on the rise as well, up 5.5 points in August according to the Conference Board. The index now stands at 133.4 (1985 = 100), up from 127.9 in July. The present situation index improved from 166.1 To 172.2 and the expectations index also increased from 102.4 last month to 107.6 this month.

“Consumer confidence increased to its highest level since October 2000 (Index, 135.8), following a modest improvement in July,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of current business and labor market conditions improved further. Expectations, which had declined in June and July, bounced back in August and continue to suggest solid economic growth for the remainder of 2018. Overall, these historically high confidence levels should continue to support healthy consumer spending in the near-term.”

Unemployment remains at historically low levels for August, unchanged at 3.9%. Nonfarm payroll employment increased by 201,000. Job gains occurred in professional and business services, health care, wholesale trade, transportation and warehousing and mining. A broader measure of unemployment that includes individuals who are unemployed but have given up looking for work fell to 7.4 %, the lowest level since April 2001.

With many indicators pointing towards a rocking economy, one thing has remained a drag on growth; wages. That is starting to change. Average hourly earnings have increased 0.4% in August following a 0.3% increase in July. This has raised annual increases in wages to 2.9%, the largest increase since July 2009. However, this has matched the current rate of inflation (compared to previous months where the rate of inflation outpaced wage growth). If the inflation rate remains steady finishing out Q3 and going into Q4, wage growth is likely to surpass that by the end of 2018.

July has reported an increase in cabinet sales of 3.8% for July over the same time frame during 2017 according to the Kitchen Cabinet Manufactures Association (KCMA)’s monthly Trend of Business Survey. Participating cabinet manufactures have notated that stock sales has increased by 9.2%, custom sales increased 8.4%, however semi-custom sales decreased 3.1% year over year.

Year to date cabinetry sales through July 2018 are up 1.5%, stock sales are up 3.2%, semi-custom decreased 1.1% and custom sales are up 3.9% so far this year.

Survey participants include stock, semi-custom, and custom companies – companies that belong to KCMA represent combined sales of approximately 70% of the U.S. kitchen cabinet and bath vanity market.

In tune with other manufacturing markets, U.S. furniture manufacturers have reported a 5% increase in sales during July 2018 over the previous month. From the recent survey of residential furniture manufacturers and distributors completed by Smith and Leonard, this 5% increase has been a consistent trend over the past couple of months. June experienced a 5% increase over May and May experienced a 15% increase over April. Year to date, orders are up 6% over 2017 with over 60% of participants reporting increased orders.

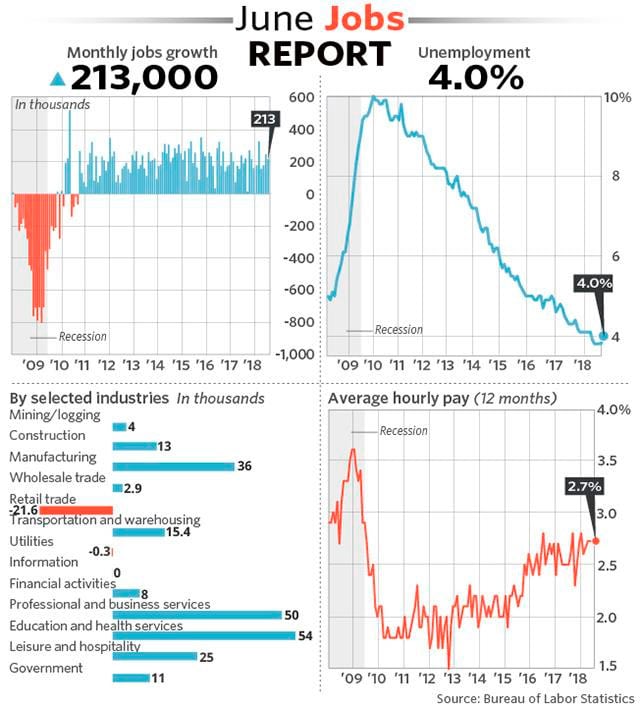

As our robust economy continues to ramp up, employers added 213 non-farm jobs to the payroll in June according to the Labor Department. Despite original forecasts of 200,000 by economists, unemployment rate crept up to 4%, up from 3.8% in May.

While the unemployment slightly increased it was largely due to an influx of eligible workers added to the labor market. Recent graduates, parents or others previously frustrated by their prospects have entered or reentered the labor force causing the labor force to grow an average of 250,000 workers each month this year. In June, the share of American adults working or looking for a job rose 0.2% to 62.9%.

The shrinking pool of labor is slowly forcing companies to raise pay as the competition for talent intensifies, but they are still managing to keep labor costs down. Hourly wages rose a modest $0.05 to $26.98. The yearly rate of pay increases was unchanged at 2.7%, sitting slightly lower than the current rate of inflation which reached 2.9% in June.

Over the past couple of months, STF has released a series of articles analyzing the U.S. housing market called “The State of U.S. Housing”. Part 1 focused on too many buyers and not enough homes. Part 2 took a look at high construction costs and public policy that hinders new construction. This month will dive deeper into home prices and the impact stagnant wage growth has had on the market.

The lack of new housing supply has been the driving force behind home values. On the national level, home prices have regained most or all of the ground lost during the recession. Home prices have risen year over year an average between 5% and 7% in the last 5 years, 2018 first quarter saw an increase of 6.9% over the same time period in 2017. While an increase in home price is fantastic news to the seller, for many buyers including first time home buyers, they are being priced out of the market. Heavy demand has led to massive bidding wars and many people have resorted to paying above asking price.

With a robust economy many economist assumed wages would rise naturally, however that has not been the case for many employees. Growth in average hourly earnings has had mediocre increases year over year averaging between 2.5% and 2.7% yearly since 2010. This increase in wages are slightly higher than the yearly rate of inflation which has remained steady at 2.2% for the past 5 years.

Not only has wage growth been stagnant but increases in average monthly rent have actually surpassed inflation. According to Zillow and the Zillow Rent Index (ZRI) rent growth has increased 2.5% annually. This along with the stagnant wage growth indicates that people have not been able to increase savings or have had to decrease savings for general living costs. For many first time home buyers, this has been the hurdle they are trying to overcome, the inability to save or increase savings for higher priced homes has shut the door on the dream of home ownership.

The U.S. labor market has surpassed expectations yet again, according to the U.S. Labor Department non-farm payroll added 223,000 jobs in May.

The increase in job openings has further pushed the unemployment figure down to 3.8%, the lowest in it has been since 2000. The labor department is now reporting that there are more job openings in the U.S. than people to fill them, there is an estimated 6.7 million job openings at the end of April with an estimated 6.3 million unemployed.

While the unemployment figure is indicative of a roaring economy, some employers are beginning to feel the strain. A tight labor pool has made it increasingly difficult for employers to fill open positions with adequate candidates. Many employers are facing a pool of unqualified people to work and in turn have begun to increase wages and incentives to attract more qualified individuals.