The State of U.S. Housing

April 2018Part 1: Too many Buyers and not enough Homes

Over the next few months, STF will be releasing a series of articles analyzing the U.S. housing market called “The State of US Housing”. The importance of the real estate sector on the U.S. economy cannot be overstated. More than half of the private wealth in the U.S. is composed of real estate assets, with $25 trillion in residential assets and $15 trillion in commercial assets. Even modest changes in the market can have massive ramifications in the U.S. and globally, as the world experienced following the bubble burst in 2009. So each month we will dive into various factors that are driving the current housing market.

This month’s focus will be on one of the biggest factors impacting today’s market: too many buyers and not enough homes.

As the tail end of the millennial generation is now entering adulthood the “American Dream” of homeownership seems to be a very problematic dream to achieve. Weighed down by the largest student debt ever seen, with 42.3 million borrowers owing a total of $1.3 billion in Federal student debt (does not include private student financing), many millennials have put off venturing into homeownership. With below average paying jobs, skyrocketing rents (especially in metropolitan areas) and the heavy burden of student debt, it has been impossible for many to save up to purchase a home up to this point. However, an expanding economy has spurred job and salary growth that has, in turn, lead to a push for homeownership.

Existing Home Sales, Month’s Supply: Previous 5 years

What many people are discovering is that finding a home (and getting it) is now more difficult than financing the home itself. A severe shortage of affordable entry-level homes has made it impossible for many buyers. February 2018 recorded an inventory level at 3.4 months, barring any additional homes going on sale the market only has enough homes for 3.4 months of sales based on current market conditions. This is one of the lowest inventory supplies on record. According to the National Association of Realtors (NAR), a healthy housing market has a 6-month supply. The number of starter homes is down 14.2% in the first quarter from a year ago, according to Trulia.

While the sale of existing homes has been tight, there has been little done to alleviate the pressure with new construction. Builders are grappling with construction worker shortages, soaring raw material costs and limited land availability and cumbersome regulations. Single-family housing starts were up 2.9% in February over January, a small jump but nowhere near enough to cover the current demand.

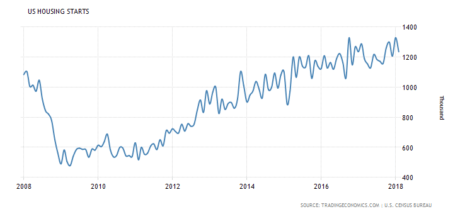

Despite more than doubling off the bottom at the depths of the financial crisis (581,000 single-family housing starts in December 2009 to 1,236,000 in February 2018), the rate of annual housing starts remains low on a historical basis. On a population-adjusted basis, housing starts averaged the equivalent of 2.5 million units per year from 1960 through 2005. From 2006 through February 2018, starts have averaged the current equivalent of just 1.1 million units per year.

The rate of growth in housing starts has been declining linearly since peaking at 28% in 2012, growing just 3% in 2017. Housing starts are expected to increase by 0 to 5% in 2018. The overall trend remains weak, however, as total starts rose just 1.98% over the past twelve months, the slowest rate of growth since 2011.

U.S. Housing Starts (Previous 10 years)