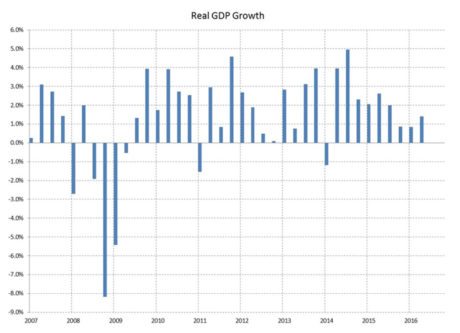

U.S. Economy: 298,000 jobs added in February

March 2017

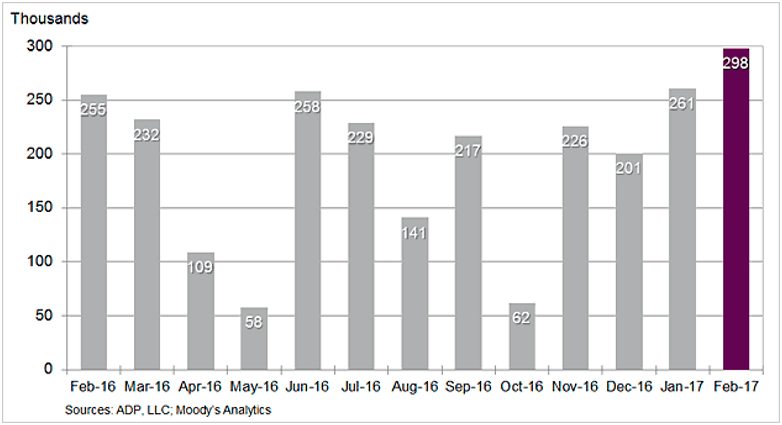

The U.S. private sector added jobs at an accelerated pace in February with the addition of 298,000 jobs shattering the market expectations of 190,000 jobs. There is a notable shift away from service-sector positions that have dominated hiring for years according to the ADP research institute.

The good producing sector added 106,000 jobs, with 32,000 in manufacturing, 66,000 in construction and 8,000 in natural resources. The service-providing sector added 193,000 jobs with professional & business leading the way at 66,000 followed by education and heath, leisure and hospitality.

The year is off to a tremendous start for job creation, according to the ADP counts. January added 261,000 positions, a number that was revised upward from the originally reported 246,000.

“Confidence is playing a large role,” Mark Zandi, chief economist of Moody’s Analytics. “Businesses are anticipating a lot of good stuff — tax cuts, less regulation. They are hiring more aggressively.”

For more information, please visit: ADP Research Institute

Cabinet Sales Start the Year out High

March 2017

According to the Kitchen Cabinet Manufactures Association (KCMA)’s monthly Trend of Business Survey, cabinetry sales had a 9.3% increase in January compared to the same month in 2016. Semi-custom sales increased 11.6% and stock cabinet sales increased 10.3%.

Survey participants include stock, semi-custom, and custom companies whose combined sales represent approximately 70 percent of the U.S. kitchen cabinet and bath vanity market. KCMA is the major trade association for kitchen cabinet and bath vanity manufacturers and key suppliers of goods and services to the industry.

For more information, please visit: KCMA

Residential Furniture Sales

March 2017

Residential furniture manufactures ended the year on a high note. According to a report from Smith Leonard, new furniture order were up 11 percent over 2015 and overall for the year up 3 percent.

Shipments were also strong, up 15% over December 2015 bringing the total increase for the year 1% over 2015, when shipments were up 6% over 2014. While only 43% of the participants reported increased shipments for 2016, 61% of the participants did report increased shipments for the month.

Backlogs fell 8 percent from November as shipments exceeded new orders while receivables and inventory levels remained in good shape.

Factory and warehouse employee levels seemed in line with current business. Factory and warehouse payrolls were up in December but that was likely the result of the strong orders and shipments, the report said.

For more information, please visit: Smith Leonard

2016 in Review: Residential Housing Market

February 2017

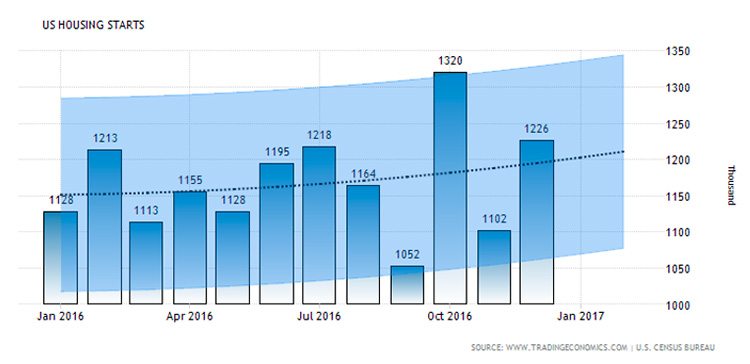

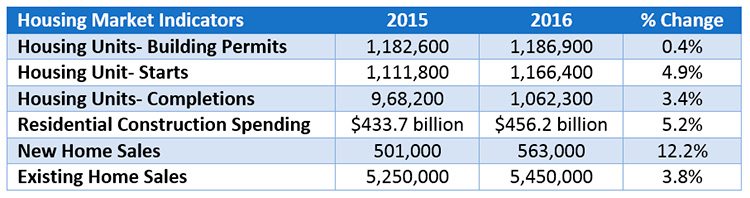

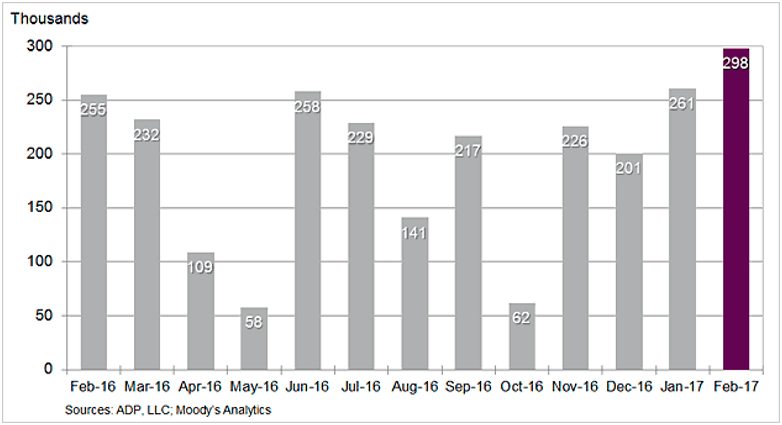

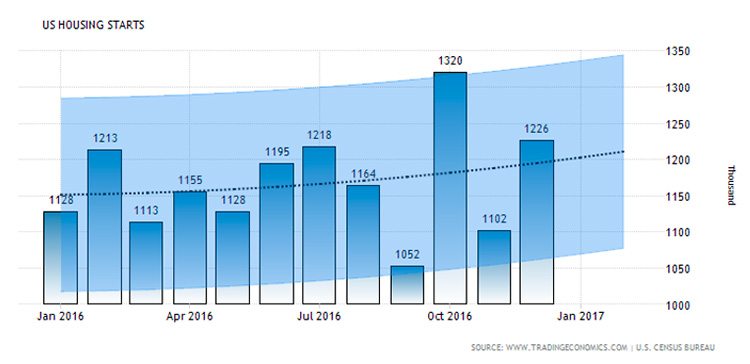

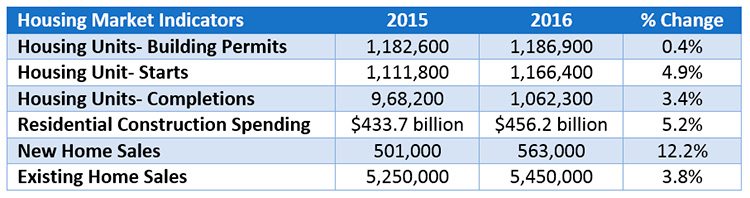

As we continue the recovery process following the recession, 2016 was a phenomenal year for the U.S. housing market. Looking at various indicators such as building permits, housing starts, residential construction spending, and the sale of new and existing homes; over all 2016 ended on a strong note.

According to the U.S Department of Housing and Urban Development, an estimated 1,186,900 housing units were authorized by building permits in 2016. While this is only a moderate 0.4% increase over 2015, privately-owned housing units and single-family authorization both increased 0.7% and 4.7%, respectively, in December 2016 over November.

Housing starts had significant growth during 2016 with a 4.9% increase over 2015. The future outlook for housing starts is positive due to the increase in building permits issued during the last month of 2016. An estimated 1,062,300 housing units were completed in 2016, an immense 9.7% increase from the 2015 figure of 968,200 units.

Spending on residential construction also improved 5.2% in 2016 over 2015. The U.S. Census Bureau estimates that $456.2 billion was spent on residential construction alone in 2016 compared to 2015 where only $433.7 billion was spent on residential construction.

While new home sales slightly dipped during the last month of the year, overall 2016 showed massive gains with a 12.2% increase in new home sales in 2016 over 2015. Existing home sales had a moderate increase of 3.8% during 2016, with a total of 5,450,000 home sales.

Although 2016 saw positive signs for the housing market and forecasts are calling for continued growth and expansion during 2017, there will be some challenges facing the housing market such as scarcity of labor and lots and the continued increase in building and construction materials. However the continued increase in employment and higher paying jobs are allowing more individuals to invest in homes.

Confidence is at an All-time High

January 2017

Builder and Consumer Confidence End the Year on a High Note

Following the November election results, builder confidence is at an eleven year high as reported by the National Association of Home Builders/Wells Fargo Housing Market Index.[1] The index jumped seven points to a level of 70, the highest reading since July 2005.

Builders and other stakeholders in the residential construction industry have high hopes for 2017, expecting the incoming administration will be reduce costly regulatory burdens, particularly for small business which have risen by more than 29% in the past five years.

Along with increases in builder confidence, consumer confidence is at its highest level since August 2001. According to the Consumer Confidence Index, December hit a level of 113.7, a 4.3 point increase from the upwardly revised November index. While Consumer Confidence decreased on the present situation index, outlook for future conditions rose to 105.5, an 11.1 point increase from November.

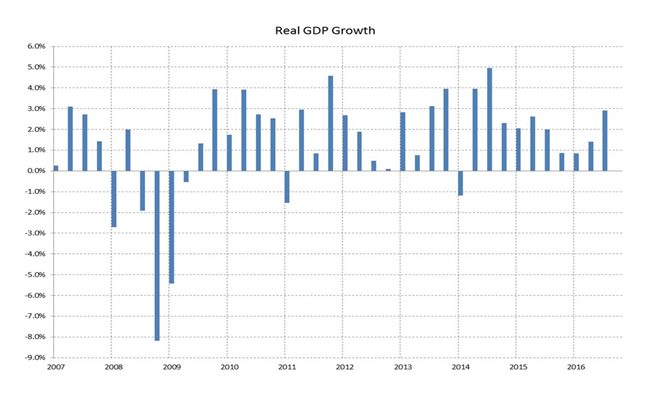

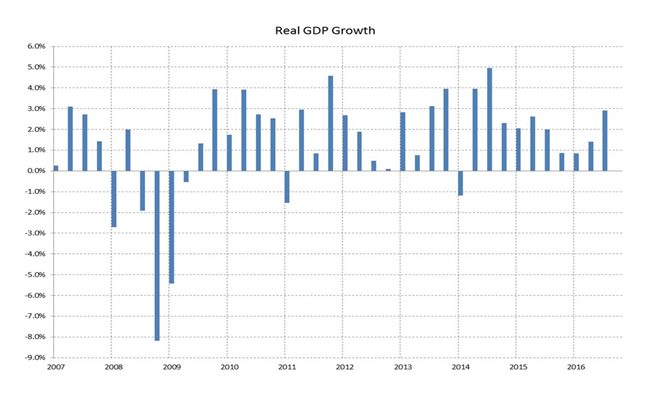

As we head in 2017, economic fundamentals continue to look optimistic with the U.S. economy finally shaking off the worst effects of the 2008 recession. The incoming administration has spurred optimism across the country with its promises of regulation and tax decreases along with reviving the manufacturing sector which has prompted an expected GDP growth of 2.1% for 2017.

[1] Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Home Sales on the Rise

January 2017

Both New Home and Existing Single-Family Home Sales Increase in November

Sales of newly built, single-family homes grew 5.2% in November to a seasonally adjusted annual rate of 592,000 according to the U.S. Census Bureau and the Department of Housing and Urban Development. Compared to November 2015, it was a 16.5% increase from the annual rate of 508,000.

Existing home sales increased for the third consecutive month and reached the highest pace since February 2007 as reported by the National Association of Realtors. November sales were up 0.7% in November from October 2016 and 15.4% increase from November 2015. The largest surge occurred in the Northeast, home sales had an 8% increase followed by a 1.4% increase in the South.

For more information: U.S. Census Bureau and National Association of Realtors

Construction Employment and its Effect on Employment

December 2016

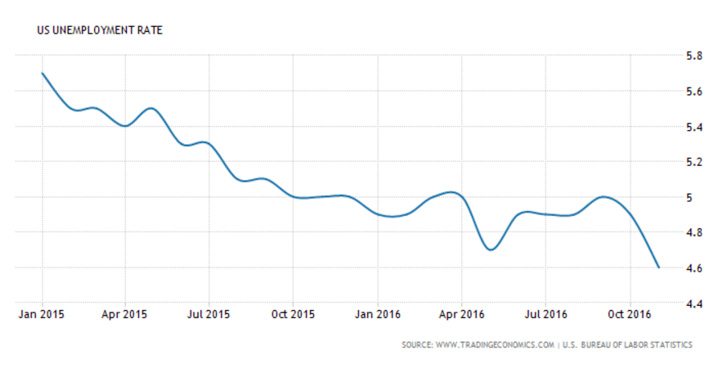

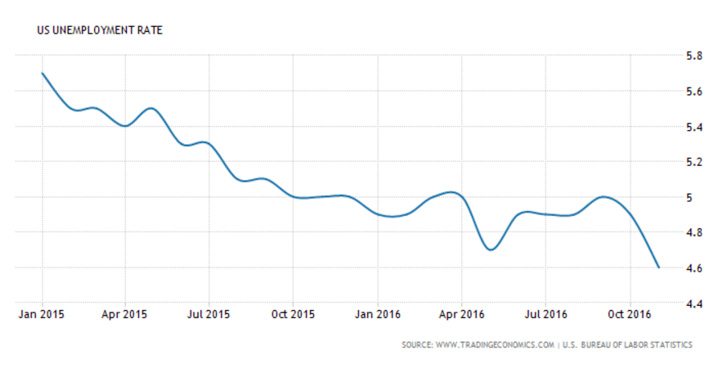

Positive signs for the U.S. economy as unemployment fell yet again to 4.6% in November, a rate not seen since August 2007, however this has had little effect on the ongoing construction labor shortage. According to the latest Houzz Renovation Barometer[1] half of building professionals reported that labor shortages are driving up the cost and slowing down timelines for projects.

Positive signs for the U.S. economy as unemployment fell yet again to 4.6% in November, a rate not seen since August 2007, however this has had little effect on the ongoing construction labor shortage. According to the latest Houzz Renovation Barometer[1] half of building professionals reported that labor shortages are driving up the cost and slowing down timelines for projects.

Approximately 9.6 million people in the U.S. work in construction and close to 3.8 million people work in residential construction, accounting for 2.5% of the U.S. employed civilian labor force. These numbers reflect steady gains that took place since 2011 when construction employment bottomed out.

California tops the list of residential constructions workers with more than a half million California residents working in construction in 2015 accounting for 3% of the state employed labor force. Coming in second is Florida with 3.7% of the employed state labor force (334,000)[2].

While residential construction employment has recovered significantly since the housing downturn, it has not been able to keep pace with the growing demand for construction labor. Although the lack of construction workers remains a problem across the country, the shortfall appears to be the most severe in the Midwest with 84% of firms reporting labor shortages.

Nevertheless, the construction labor shortage is not affecting industry confidence. The Housing Market Index a monthly survey by the National Association of Home Builders rated the market conditions for the sale of new homes at a confidence level of 63, indicating a very high level of market confidence.[3] The renovation industry has confidence scores in Q3 2016 ranging from 60 to 72, indicating that renovation professionals are feeling good overall.[4]

[1] The Houzz Renovation Barometer index tracks sector optimism among architects, designers, general contractors and remodelers, design-build firms, building and renovation specialty firms, and landscape and outdoor specialty firms.

[2] According to a study on residential construction employment across states and congressional districts 2015 by the National Association of Home Builders

[3] The National Association of Home Builders Housing Market Index (HMI) rates market conditions for the sale of new homes at the present time, ranges from 0-100 where anything over 50 indicates positive levels of market confidence.

[4] According to the Houzz Renovation Barometer

[1] The Houzz Renovation Barometer index tracks sector optimism among architects, designers, general contractors and remodelers, design-build firms, building and renovation specialty firms, and landscape and outdoor specialty firms.

[2] According to a study on residential construction employment across states and congressional districts 2015 by the National Association of Home Builders

[3] The National Association of Home Builders Housing Market Index (HMI) rates market conditions for the sale of new homes at the present time, ranges from 0-100 where anything over 50 indicates positive levels of market confidence.

[4] According to the Houzz Renovation Barometer.

Housing Market Gaining on Multiple Fronts

December 2016

The U.S. housing market has continued to strengthen throughout this year and October 2016 continued the trend with notable gains in building permits, housing starts and housing completions according to information released by the U.S. Census Bureau.

Single-family building permits were at a rate of 762,000, a 2.7% above the revised September figure of 742,000. Single family housing starts also saw notable gains with an increase in 10.7% above the revised September rate. Single-family housing completion sin October were at a seasonally adjusted annual rate of 749,000, this is a 3.9% increase above the previous month.

Privately-owned housing building permits had a small increase of 0.3% from September, however a 4.6% increase over October 2015. Housing starts were at a seasonally adjusted rate of 1.323 million, a 25.5% increase above September and a 23.3 percent increase over the same month in 2015. Housing completions grew 5.5% over the September rate of 1 million.

U.S. Economy: GPD Growth in Third Quarter

November 2016

The U.S. Economy pushed ahead and surpassed expectations with a 2.9% increase in GDP during the third quarter according to The Bureau of Economic Analysis (BEA). This is more than double the 1.4% increase in the second quarter and is inching towards the pre 2009 recession growth rate of 3%.

The recent advances in GDP was very broad based, with most industries advancing however a push from consumer spending and exports helped strengthen this quarters GDP. Overall the acceleration in growth is encouraging and economists are expecting continued growth over the next few quarters.

Optimism for the Remodeling Market

November 2016

The National Association of Home Builder (NAHB) Remodeling Market Index (RMI) posted a reading of 57 in the third quarter for 2016, an increase of four points from the previous quarter.

The overall RMI is an average of two main sub-indices, one that tracks current market conditions and another tracking future market conditions. Along with the current indicators, future market conditions increased by 5 points from the previous quarter to 58.

An RMI above 50 indicated that more remodelers report market activity is higher compared to the previous quarter. “Remodelers nationwide are seeing increased demand for major and minor addition jobs and calls for bids, leading to an increase in both current and future market indicators,” says 2016 NAHB Remodelers chair Tim Shigley, CAPS, CGP, GMB, GMR, a remodeler from Wichita, Kan. “However, ongoing labor shortages continue to challenge their ability to meet the increased demand.”

Remodeling is currently being driven by the rising home values and tightening of for-sale inventories in many markets around the county.

U.S. Home Sales Increase in September

November 2016

According to the U.S. Census Bureau and the Department of Housing and Urban Development, sales of new single-family houses in September 2016 were at a seasonally adjusted annual rate of 593,000. This is a 3.1% increase from the August rate of 575,000 and 29.8% above the September 2015 estimate of 457,000.

For more information, please visit U.S. Census Bureau

U.S. Economy: Positive Signs for GDP

October 2016

The Bureau of Economic Analysis (BEA) released the revised second quarter GDP growth of 2016. Real GDP grew at a 1.4% seasonally adjusted rate, a modest increase from the 1.1% previous estimate. The growth can be attributed to strength from consumer spending, bottoming out of oil prices and a rebound in equipment spending.

The Bureau of Economic Analysis (BEA) released the revised second quarter GDP growth of 2016. Real GDP grew at a 1.4% seasonally adjusted rate, a modest increase from the 1.1% previous estimate. The growth can be attributed to strength from consumer spending, bottoming out of oil prices and a rebound in equipment spending.

This growth in GDP seems to be accelerating following two quarters below 1% growth. Economists are predicting that the third quarter of 2016 will ramp up the GDP growth rate with forecasts as high as 3.1%.

With about two-thirds of total output coming from consumer spending, a 4.3% increase, with last quarter’s gain being the largest increase since 2014. It comes as no surprise that consumer confidence has also strengthened to its highest level in nine years. The Conference Board’s consumer-confidence index increased to a seasonally adjusted 104.1 in September, marginally higher than the estimated 99.1 that economist expected during September.

“Growth is a lot stronger than it looks” based on first-half GDP figures, said Scott Brown, chief economist at Raymond James & Associates. “We’re still seeing a pretty strong jobs market, we expect wage growth to pick up, and gasoline prices are relatively low. That’s all a pretty good backdrop.”

Positive signs for the U.S. economy as unemployment fell yet again to 4.6% in November, a rate not seen since August 2007, however this has had little effect on the ongoing construction labor shortage. According to the latest Houzz Renovation Barometer[1] half of building professionals reported that labor shortages are driving up the cost and slowing down timelines for projects.

Positive signs for the U.S. economy as unemployment fell yet again to 4.6% in November, a rate not seen since August 2007, however this has had little effect on the ongoing construction labor shortage. According to the latest Houzz Renovation Barometer[1] half of building professionals reported that labor shortages are driving up the cost and slowing down timelines for projects.

The Bureau of Economic Analysis (BEA) released the revised second quarter GDP growth of 2016. Real GDP grew at a 1.4% seasonally adjusted rate, a modest increase from the 1.1% previous estimate. The growth can be attributed to strength from consumer spending, bottoming out of oil prices and a rebound in equipment spending.

The Bureau of Economic Analysis (BEA) released the revised second quarter GDP growth of 2016. Real GDP grew at a 1.4% seasonally adjusted rate, a modest increase from the 1.1% previous estimate. The growth can be attributed to strength from consumer spending, bottoming out of oil prices and a rebound in equipment spending.