Construction Employment and its Effect on Employment

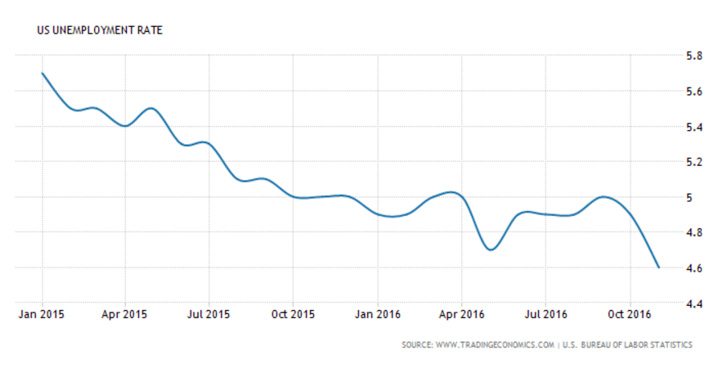

December 2016 Positive signs for the U.S. economy as unemployment fell yet again to 4.6% in November, a rate not seen since August 2007, however this has had little effect on the ongoing construction labor shortage. According to the latest Houzz Renovation Barometer[1] half of building professionals reported that labor shortages are driving up the cost and slowing down timelines for projects.

Positive signs for the U.S. economy as unemployment fell yet again to 4.6% in November, a rate not seen since August 2007, however this has had little effect on the ongoing construction labor shortage. According to the latest Houzz Renovation Barometer[1] half of building professionals reported that labor shortages are driving up the cost and slowing down timelines for projects.

Approximately 9.6 million people in the U.S. work in construction and close to 3.8 million people work in residential construction, accounting for 2.5% of the U.S. employed civilian labor force. These numbers reflect steady gains that took place since 2011 when construction employment bottomed out.

California tops the list of residential constructions workers with more than a half million California residents working in construction in 2015 accounting for 3% of the state employed labor force. Coming in second is Florida with 3.7% of the employed state labor force (334,000)[2].

While residential construction employment has recovered significantly since the housing downturn, it has not been able to keep pace with the growing demand for construction labor. Although the lack of construction workers remains a problem across the country, the shortfall appears to be the most severe in the Midwest with 84% of firms reporting labor shortages.

Nevertheless, the construction labor shortage is not affecting industry confidence. The Housing Market Index a monthly survey by the National Association of Home Builders rated the market conditions for the sale of new homes at a confidence level of 63, indicating a very high level of market confidence.[3] The renovation industry has confidence scores in Q3 2016 ranging from 60 to 72, indicating that renovation professionals are feeling good overall.[4]

[1] The Houzz Renovation Barometer index tracks sector optimism among architects, designers, general contractors and remodelers, design-build firms, building and renovation specialty firms, and landscape and outdoor specialty firms.

[2] According to a study on residential construction employment across states and congressional districts 2015 by the National Association of Home Builders

[3] The National Association of Home Builders Housing Market Index (HMI) rates market conditions for the sale of new homes at the present time, ranges from 0-100 where anything over 50 indicates positive levels of market confidence.

[4] According to the Houzz Renovation Barometer

[1] The Houzz Renovation Barometer index tracks sector optimism among architects, designers, general contractors and remodelers, design-build firms, building and renovation specialty firms, and landscape and outdoor specialty firms.

[2] According to a study on residential construction employment across states and congressional districts 2015 by the National Association of Home Builders

[3] The National Association of Home Builders Housing Market Index (HMI) rates market conditions for the sale of new homes at the present time, ranges from 0-100 where anything over 50 indicates positive levels of market confidence.

[4] According to the Houzz Renovation Barometer.