Hard Hitting Designs

April 2018

STF is hitting it out the ballpark with our latest additions: Weathered Ash and Aged Ash. Ashwood is known for making some of the best baseball bats and was the inspiration for these two heavy hitters. Utilizing the same structure, in two tones, you are sure to find one that hits it home.

Aged ash is an almond tone, perfect for the classic kitchen style similar to that of maple but with a more contemporary feel. Matching HPL can be found with Formica’s Aged Ash (8844)

For refacing jobs who want a modern look, the grey toned Weathered Ash would be perfect. Matching HPL can be found with Formicas Weathered Ash (8842).

Pictured on the left: Weathered Ash

Aged Ash

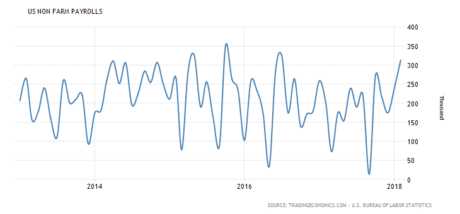

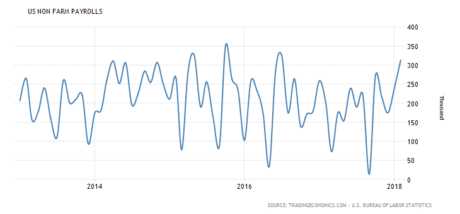

U.S. Adds 313,000 New Jobs in February

March 2018

Non-farm payroll has increased yet again, surprising economists who predicted only a moderate increase in the jobs report for February. A hot labor market has shown no sign of cooling as the U.S. has added 313,000 jobs in February, the most since July 2016.

The portion of Americans over 16 working or looking for jobs increased from 62.7% to 63%, which has kept the unemployment rate unchanged at 4.1%, a 17-year low.

The unseasonably warm weather has allowed the construction segment to add 61,000 jobs, the most notable job gains. Followed closely by retail (50,000 positions), professional and business services (50,000 positions), and manufactures (31,000 positions).

US Non-Farm Payrolls

A Brand New Look

March 2018

En Vogue Olive was one of the first colors introduced by STF in our 3DL product line and it has continued to be a successful design over the years. By popular demand, Synergy is introducing a new, lighter version: Olivewood.

The exotic Olivewood structure utilizes a slightly lighter tone than its darker counterpart, En Vogue Olive, giving off a warmer feel. Create a striking finished product by utilizing it in all your kitchen cabinets or mix it up with a solid color to create a beautiful accent piece.

STF – En Vogue Olive

U.S. Economy: On the right track

February 2018

Consumers and business powered the economy to an estimated 2.6% growth in GDP during the fourth quarter of 2017. While this fell short of some economists original forecasts of 3% growth, overall during 2017 the economy grew 2.3%, compared to 2016 which only saw a 1.6% growth. This is the longest continued expansion of GDP on record.

Consumer spending accelerated to 3.8% annual pace of growth, the fastest it’s been in almost two years. Business also increased spending on equipment by 11.4% and investment in new housing jumped 11.6%.

The economy continues to hum along,” according to Ryan Sweet, an economist at Moody’s Analytics. “This is far from doom and gloom. Businesses are investing aggressively and consumers continue to spend at a very strong pace. We got a bit spoiled by 3 percent-plus growth in the last couple of quarters, but that streak was eventually going to come to an end.”

Recently passed tax cuts for individuals and business are expected to give the economy another major boost in 2018. The Atlanta Federal Reserve is already projecting a very robust first quarter of 2018, stating the U.S. economy is on track to grow at a 5.4% annualized rate.

Image courtesy of Global Business Outlook

Promising 2018 Start for U.S. Job Market

February 2018

The beginning of 2018 has proved to be off to a good start in the U.S. job market. After a slight lull in December, nonfarm payroll increased by 200,000 in January surpassing original forecasts according to the Labor Department. The unemployment rate held at 4.1%, matching the lowest since 2000.

Breaking down January data, construction reported by the biggest gain by sector with 36,000; manufacturing also showed a gain of 15,000 and durable goods-related industries added 18,000. The focus on construction and manufacturing indicates a resurgence in factory activity and rebound in housing.

As the economy moves towards full employment, more companies are finding it harder to hire qualified candidates. In order to attract qualified workers companies are now increasing wages at a rate unseen since 2009. January experienced a 2.9% increase in wages, a sign that the booming economy is finally starting to reach American’s pocketbooks. Separate data released by the Bureau of Labor showed that private-sector wages and salaries rose 2.8% in the fourth quarter of 2017, compared to a year earlier.

Even claims for state unemployment benefits decreased 9,000 to a seasonally adjusted rate of 221,000. Last week marked the 153rd straight week that claims remained below the 300,000 threshold, which is associated with a strong labor market. That is the longest stretch since 1970 when the labor market was much smaller.

Image courtesy of Hubspot

Wood Industry Leaders report 5% Sales Gains

February 2018

Sales for the FDMC 300 group grew 5.4% in 2017 over the previous year to $52.209 billion. A year ago, the sales for the group of companies grew 5% in 2016 over the previous year to $48.786 billion.

This group of the 300 largest North American cabinets, millwork, furniture, and fixture manufactures recorded a sixth consecutive year of sales expansion, after the recession which sale declines from 2007-2011.

For more information: FDMC 300

Image courtesy of Wood Working Network

U.S. Furniture Orders Grow in October

January 2018

U.S. furniture factory orders grew 8% in October 2017 over the same period in 2016. According to the monthly report of residential furniture manufacturers and distributors, shipments increased 8% over October 2016. Receivable levels increased 1% over October 2016, very much in line with shipments.

Inventories were up 5% over October 2016. October levels seemed to get back in line with current business conditions.

Source: Shipperoo

U.S. Kitchen Cabinet Sales Up

January 2018

U.S. kitchen and bath cabinetry sales in November 2017 rose 1.8% from November 2016, according to the Kitchen Cabinet Manufacturers Association’s (KCMA). Year-to-date cabinetry sales increased 2.8% over the same period in 2016. Semi-custom sales were up 3.7% in November and were 3.5% higher through the first 11 months compared to 2016. Custom cabinetry sales improved 2.2% from the same month last year. Stock sales inched upward by 0.1% in November and year-to-date sales increased from 2016 by 3%.

A kitchen decorated by STF

Marseille In Action

January 2018

What do you think of when hearing the word Laminates?

Typically the response we hear has been kitchen cabinets. However, within recent years 3D laminates have expanded into other markets such as retail fixtures, wall paneling, healthcare, and education. As a more versatile material than traditional laminates to work with, the applications are endless for any project.

Take a look, at the gallery below to see the range of applications for a local grocery chain that utilized STF’s Marseille.

U.S. Housing Market

January 2018

“There’s no place like home.” A quote from the classic movie, The Wizard of Oz, has become the mantra for many Americans who are pursuing the American Dream of homeownership. Reaping the benefits of the growing economy; healthy job market and income growth has fueled demand for houses, including more millennial first-time buyers. Existing-home sales surged for the third straight month in November and reached their strongest pace in almost 11 years. According to the National Association of Realtors, existing homes sales were up 5.6% in November over October, a seasonally adjusted annual rate of 5.81 million. The fastest pace since July 2007, new single-family house sales increased 17.5% in November over October to a seasonally adjusted annual rate of 733,000. This is a 26.6% increase over the same time last year.

“The greater home sales will stoke the fires for stronger economic growth next year as consumers spend more to furnish their new homes with new appliances and furniture and all the decorations and trimmings,” said Chris Rupkey, chief economist MUFG in New York. Even though the housing market has experienced robust growth at fast paces there are continuing constraints that will affect the housing market going into 2018. Total housing inventory at the end of November decreased 7.2% and has fallen year-over-year for 30 consecutive months. Current inventory levels are at a 3.4 month supply. Low inventory has elevated home prices and has sidelined some first-time buyers who cannot find suitable lower end market homes. Due to low inventory, the median home price has increased 5.8% from a year ago, the 69th consecutive month of year-on-year price gains.

Additionally, for new homes being built, a consistent shortage of skilled labor and lots has tightened many builders ability to add new homes to the market. Builders are pushing for more housing starts, with a 3.3 percent increase in housing starts in November over October. However, the supply is unable to keep up with current demand.

Additionally, for new homes being built, a consistent shortage of skilled labor and lots has tightened many builders ability to add new homes to the market. Builders are pushing for more housing starts, with a 3.3 percent increase in housing starts in November over October. However, the supply is unable to keep up with current demand.

The National Association of Realtors says it anticipates a slightly negative impact on the housing market from the overhaul of the U.S. tax code. The cap for property and state and local income tax is now set at 10,000, the prospect for a bigger tax bill may discourage some buyers. Moody's Analytics chief economist Mark Zandi has warned that the tax revamp would weigh on house prices, with the Northeast corridor, South Florida, big Midwestern cities, and the West Coast suffering the biggest price declines.

New Home Sales Hit a 10-Year High

December 2017

Sales of new U.S. single-family homes unexpectedly rose in October to a 10 year high. In October, sales were at a seasonally adjusted annual rate of 685,000. This is a 6.2% increase over September 2017 and an 18.7% increase over October 2016. The sale of new homes sales consists of eleven percent of overall home sales.

Mild weather helped to boost new home sales last month. Sales soared 30.2% in the Northeast to their highest level since October 2007. They rose 1.3% in the South also to a 10-year high. Sales jumped 17.9% in the Midwest and climbed 6.4% in the West.

Existing home sales also increased in October to their strongest pace since earlier this summer, a 2% increase over September. But supply shortages have continued to lead to fewer closings on an annual basis for the second straight month.

US Jobs Report More Gains

December 2017

The U.S. job market has finally begun to shake off the last impacts of the hurricane season that hit Florida and Texas earlier this year. In November, 228,000 nonfarm jobs were added to the economy, as the unemployment rate remained at a 17 year low of 4.1%.

Most notably, the manufacturing segment had the largest gains with a 1.5% increase in jobs in 2017 over 2016. Manufacturers added 31,000 jobs during November alone, with unemployment in this sector at 2.6%, the lowest on record for the series since January 2000.

Additionally, for new homes being built, a consistent shortage of skilled labor and lots has tightened many builders ability to add new homes to the market. Builders are pushing for more housing starts, with a 3.3 percent increase in housing starts in November over October. However, the supply is unable to keep up with current demand.

Additionally, for new homes being built, a consistent shortage of skilled labor and lots has tightened many builders ability to add new homes to the market. Builders are pushing for more housing starts, with a 3.3 percent increase in housing starts in November over October. However, the supply is unable to keep up with current demand.