We Have Moved!

April 2017

Here We Grow Again…

Exciting things are happening at STF! It’s with great anticipation and pleasure to let you know that as of May 1, 2017, we will be moving into a bigger and better location. This 25,000 square foot facility with help us maintain the added design offerings, increase in our current inventory levels and bring more value added services to our current line. We will continue to update you as progress permits.

We have been operating out of Deerfield Beach since 2010 and your loyal business and support is the main reason we have grown so much over the last seven years. We look forward to continuing our relationship in the years to come with a bigger inventory, larger selection and more services.

Our business, including website, email, and telephones, will be fully operational during the moving process and you will not experience any changes or delays in service or shipping.

Please update your records with our new address:

12175 NW 39th Street

Coral Springs, FL 33065

All other information will remain the same:

Office: (954) 420-9553

Fax: (866) 783-4381

Email: Info@SynergyThermoFoils.com

www.SynergyThermoFoils.com

As a valued customer we thank you for taking the time to update your records. Please feel free to contact us at 954-420-9553 with any questions or concerns.

We Have Moved!

April 2017

Here We Grow Again…

Exciting things are happening at STF! It’s with great anticipation and pleasure to let you know that as of May 1, 2017, we will be moving into a bigger and better location. This 25,000 square foot facility with help us maintain the added design offerings, increase in our current inventory levels and bring more value added services to our current line. We will continue to update you as progress permits.

We have been operating out of Deerfield Beach since 2010 and your loyal business and support is the main reason we have grown so much over the last seven years. We look forward to continuing our relationship in the years to come with a bigger inventory, larger selection and more services.

Our business, including website, email, and telephones, will be fully operational during the moving process and you will not experience any changes or delays in service or shipping.

Please update your records with our new address:

12175 NW 39th Street

Coral Springs, FL 33065

All other information will remain the same:

Office: (954) 420-9553

Fax: (866) 783-4381

Email: Info@SynergyThermoFoils.com

www.SynergyThermoFoils.com

As a valued customer we thank you for taking the time to update your records. Please feel free to contact us at 954-420-9553 with any questions or concerns.

Residential Construction Spending Continues at Highest Level Since 2007

April 2017

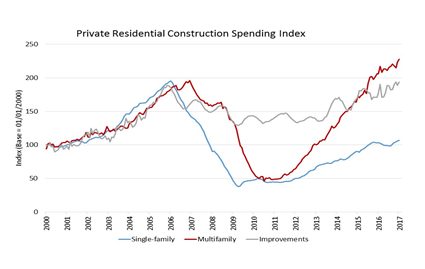

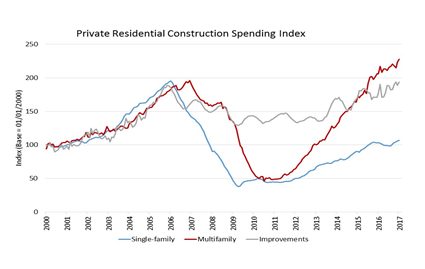

Residential construction spending continues on its fifth consecutive month of growth. According to data released by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development private construction was at a seasonally adjusted rate of $917.3 billion for the month of February with $484.7 billion on residential construction. This is a 1.8% increase above the residential construction spending in January and up 6.4% from the same period one year earlier. This is the highest level since August 2007.

Multifamily construction spending also continued record breaking growth with a 2% increase to $64.5 billion over January 2017 and a 10.7% increase over February 2016. Single family construction spending also improved by 1.2%, continuing steady growth since October of 2016.

Builder Confidence Reaches 12 Year High

April 2017

According to the National Association of Home Builders and Wells Fargo Housing Market Index (HMI) builder confidence in the market for newly build single-family homes jumped six points to a level of 71. This is the highest builder confidence reading since June 2005.

The HMI benefited from unseasonably warm weather at the start of 2017 which improved demand and construction conditions. While builders are extremely confident, there is expected to be some restraint moving forward. There are challenges that they continue to face including shortages of lots and labor, increasing mortgage rates and rising material prices.

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Cabinet Sales on the Rise

April 2017

According to participating members in the Kitchen Cabinet Manufacturers Association (KCMA)’s monthly Trend of Business Survey, cabinetry sales increased 4.3% in February 2017 compared to sales for February 2016. Stock cabinet sales increased 2.9%, semi-custom sales increased 6.6%, and custom sales increased 1.7% compared to the same period last year.

Survey participants include stock, semi-custom, and custom companies whose combined sales represent approximately 70 percent of the U.S. kitchen cabinet and bath vanity market. KCMA is the major trade association for kitchen cabinet and bath vanity manufacturers and key suppliers of goods and services to the industry. All major U.S. cabinet manufacturing companies belong to KCMA. Sixty-three percent of KCMA cabinet manufacturer members report sales below $10 million annually, reflecting the importance of small manufacturers in the industry. KCMA has been compiling and reporting industry sales data for more than forty years.

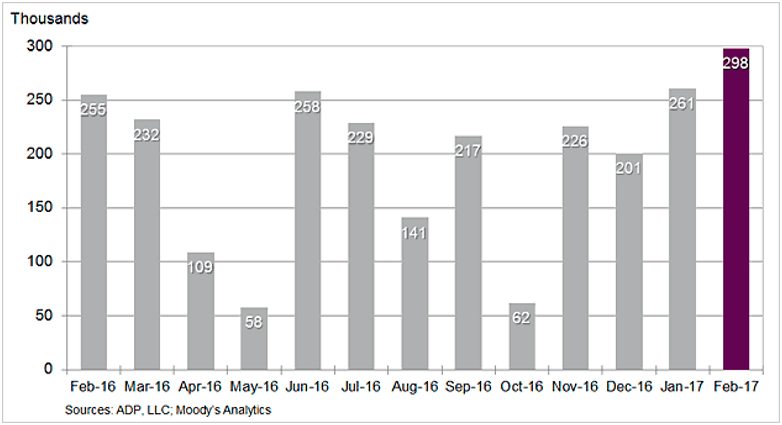

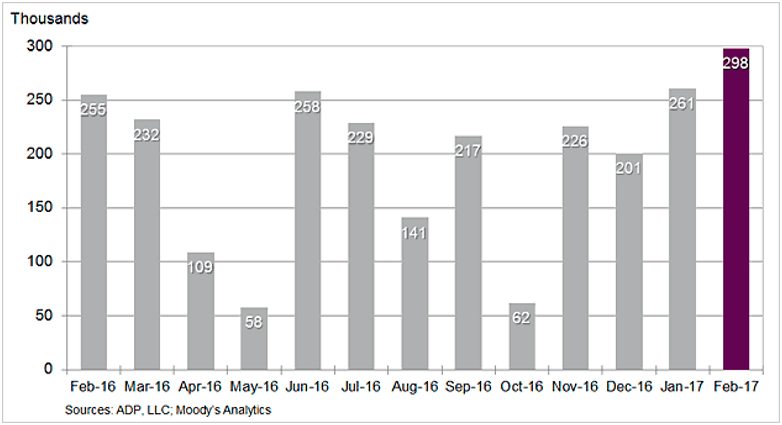

U.S. Economy: 298,000 jobs added in February

March 2017

The U.S. private sector added jobs at an accelerated pace in February with the addition of 298,000 jobs shattering the market expectations of 190,000 jobs. There is a notable shift away from service-sector positions that have dominated hiring for years according to the ADP research institute.

The good producing sector added 106,000 jobs, with 32,000 in manufacturing, 66,000 in construction and 8,000 in natural resources. The service-providing sector added 193,000 jobs with professional & business leading the way at 66,000 followed by education and heath, leisure and hospitality.

The year is off to a tremendous start for job creation, according to the ADP counts. January added 261,000 positions, a number that was revised upward from the originally reported 246,000.

“Confidence is playing a large role,” Mark Zandi, chief economist of Moody’s Analytics. “Businesses are anticipating a lot of good stuff — tax cuts, less regulation. They are hiring more aggressively.”

For more information, please visit: ADP Research Institute

Cabinet Sales Start the Year out High

March 2017

According to the Kitchen Cabinet Manufactures Association (KCMA)’s monthly Trend of Business Survey, cabinetry sales had a 9.3% increase in January compared to the same month in 2016. Semi-custom sales increased 11.6% and stock cabinet sales increased 10.3%.

Survey participants include stock, semi-custom, and custom companies whose combined sales represent approximately 70 percent of the U.S. kitchen cabinet and bath vanity market. KCMA is the major trade association for kitchen cabinet and bath vanity manufacturers and key suppliers of goods and services to the industry.

For more information, please visit: KCMA

Residential Furniture Sales

March 2017

Residential furniture manufactures ended the year on a high note. According to a report from Smith Leonard, new furniture order were up 11 percent over 2015 and overall for the year up 3 percent.

Shipments were also strong, up 15% over December 2015 bringing the total increase for the year 1% over 2015, when shipments were up 6% over 2014. While only 43% of the participants reported increased shipments for 2016, 61% of the participants did report increased shipments for the month.

Backlogs fell 8 percent from November as shipments exceeded new orders while receivables and inventory levels remained in good shape.

Factory and warehouse employee levels seemed in line with current business. Factory and warehouse payrolls were up in December but that was likely the result of the strong orders and shipments, the report said.

For more information, please visit: Smith Leonard

5 Years Strong

February 2017

While some design trends come and go, Hemlocks Grey and Driftwood are two designs that are becoming timeless classics. Introduced into the STF stocking program 5 years ago, utilizing the same design structure in two tones of grey make Hemlocks Grey and Driftwood perfect complementary designs. As two of the first design offerings in a heavy emboss, these two colors have become some of the most popular designs from STF.

Driftwood has corresponding TFL matches from Flakeboard and American Laminates. Hemlocks Grey has corresponding TFL matches from KML, Egger and Salt/Cleaf. Synergy Thermal Foils also offers the complementary edgebanding for these two designs.

Driftwood

Hemlocks Grey

2016 in Review: Residential Housing Market

February 2017

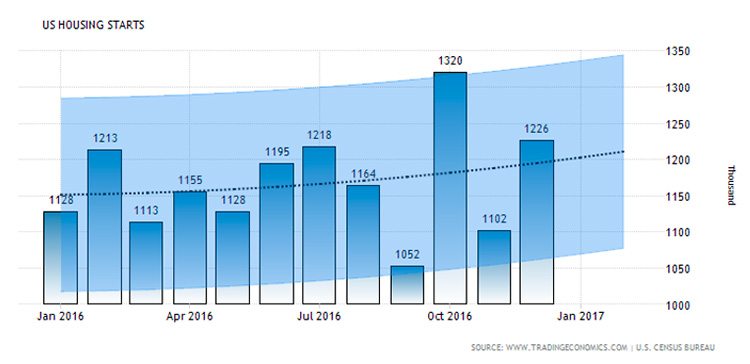

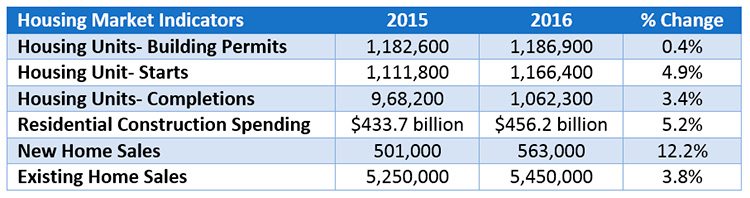

As we continue the recovery process following the recession, 2016 was a phenomenal year for the U.S. housing market. Looking at various indicators such as building permits, housing starts, residential construction spending, and the sale of new and existing homes; over all 2016 ended on a strong note.

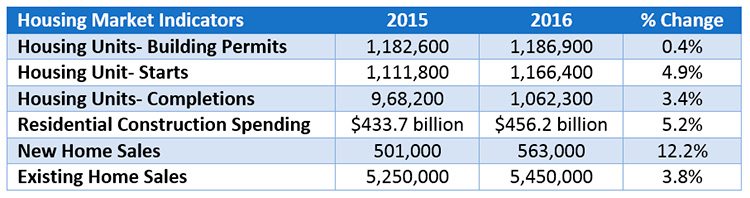

According to the U.S Department of Housing and Urban Development, an estimated 1,186,900 housing units were authorized by building permits in 2016. While this is only a moderate 0.4% increase over 2015, privately-owned housing units and single-family authorization both increased 0.7% and 4.7%, respectively, in December 2016 over November.

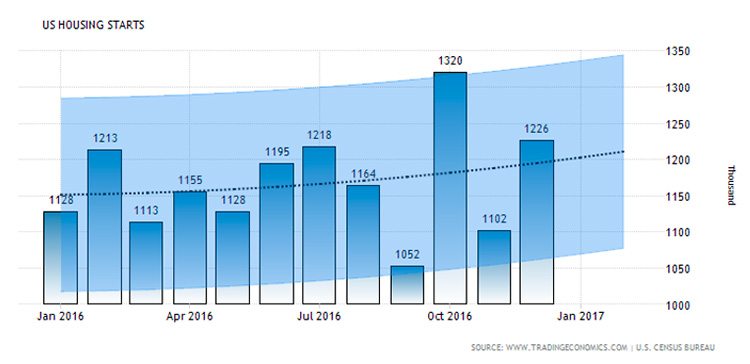

Housing starts had significant growth during 2016 with a 4.9% increase over 2015. The future outlook for housing starts is positive due to the increase in building permits issued during the last month of 2016. An estimated 1,062,300 housing units were completed in 2016, an immense 9.7% increase from the 2015 figure of 968,200 units.

Spending on residential construction also improved 5.2% in 2016 over 2015. The U.S. Census Bureau estimates that $456.2 billion was spent on residential construction alone in 2016 compared to 2015 where only $433.7 billion was spent on residential construction.

While new home sales slightly dipped during the last month of the year, overall 2016 showed massive gains with a 12.2% increase in new home sales in 2016 over 2015. Existing home sales had a moderate increase of 3.8% during 2016, with a total of 5,450,000 home sales.

Although 2016 saw positive signs for the housing market and forecasts are calling for continued growth and expansion during 2017, there will be some challenges facing the housing market such as scarcity of labor and lots and the continued increase in building and construction materials. However the continued increase in employment and higher paying jobs are allowing more individuals to invest in homes.

Stay up to date with STF’s current designs

February 2017

We want to make sure you start off the Year right! Please check your sample book date to ensure you have the most recent binder with our current design offerings.

If you would like to request an updated sample book please email info@synergythermofoils.com.

100 and Counting…

January 2017

STF strives to offer a wide range of designs with each passing years always staying current with the market trends. This month STF is celebrating its 100th addition to our international design collection with the latest color Fontana Night.

While some design trends come and go others have remained becoming timeless classics. STF’s North American Stocking program proudly offers 90 different designs in a variety of colors and textures. From time-honored designs such as Chocolate Pear and Honey Maple to new and trending colors Silverwood and Smokewood. Synergy Thermal Foils has you covered for any and all of your RTF needs.