Economic Impact of the Housing Market: New Construction

October 2016

Following the housing market bubble burst, 7 years later the housing market has in part recovered to pre-recession times. But what does that mean for the economy?

According to data released by the National Association of Home Builders (NAHB) the economic impact of the housing has a substantial effect on the overall economy. For every 1,000 single-family homes built approximately 2.975 jobs are created and totals of $116 million in net business income. Looking deeper into the jobs created approximately half are in construction alone.

The impact of 2,000 apartments built result in 2 jobs created with about half of those in construction and manufacturing. This would bring a total of $46 million in net business income with $25 million in construction and $7 million in manufacturing.

For more information: NAHB

Today’s Kitchen Design Trends

October 2016

Kitchens are a gathering place in most homes and it comes to no surprise that kitchen and bath remodels are most common. According to Harvard Joint Center for Housing Studies (HJCHS), kitchen-related remodeling may exceed new construction next year, with estimates for home remodels and renovations as high as $321 billion by mid-2017. One of the driving forces behind the increase in renovations and remodeling has been the rebounding equity that homeowners have.

With more home-owners choosing to remodel, there has been a larger emphasis on features and design over cost. What are the design trends we are seeing today?

Cabinetry

Wood-based cabinets are still the most common, however there is a variation in the panel type of wood cabinets with 60% of home-owners having a wood finished cabinetry with a raised panel and 25% having a wood finish with a flat panel, 5% are laminate and 10% listed as other.

The most popular color is white with 34%, followed by wood (medium tone) at 20%, gray at 9%, wood (dark tone) at 7% and multi-colored at 6%. Although Zillow recently reported an increase in tuxedo design cabinetry using complimentary colors as an alternative to traditional cabinetry.

Counter Tops

Granite counter tops are overwhelmingly popular with 64% followed by laminate at 14%, engineered stone 9%, solid-surface 9% and other 4%. Of those with granite counter tops three colors choices stand out: 30% of respondents have multi-colored, 26% have white, 18% have black, and 26% reporting other.

Appliances

An overwhelming 79% of respondents prefer stainless steel appliances with only 6% black and 4% white.

Sources:

2016 Annual Builder Practices Report

Houzz

Harvard Joint Center for Housing Studies

U.S. Builder Confidence Surges in September

September 2016

Builder confidence in the market for newly built, single-family homes in September jumped six points to 65 from a revised August reading of 59. This marks the highest HMI level since October 2015 according to the National Association of Home Builders.

All three HMI components rose this month, with current sales conditions rising 6 points to 71 and sales expectations also climbing 5 points to 71. The third component measuring traffic of prospective buyers went up 4 points to 73.

Even with decrease in U.S. housing starts, builders in many markets are confident that the single-family housing market will continue the upward momentum to build throughout the remainder of the year and into 2017.

Derived from a monthly NAHB survey, the HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months. Scores from each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good rather than poor.

For more information: NAHB

Canadian Building Permits Inch Upward

September 2016

Municipalities issued building permits worth $6.5 billion in July, a 0.8% increase from the previous month. The advance was largely the result of higher construction for institutional and industrial buildings.

Residential building permits were down 2% to $4 billion in July, the fourth consecutive monthly decrease. In the non-residential sector, the value of building permits increases 5.6% to $2.4 billion. This gain followed two consecutive months of declines.

The Best States for Woodworking

August 2016

“America’s Top States for Business 2016,” compiled by CNBC, ranks the best work states, with the Top 10 in order of: Utah, Texas, Colorado, Minnesota, North Carolina, Washington, Michigan, Georgia, Iowa and Florida. CNBC compiled its list based on 10 categories of competitiveness: Workforce, Cost of Doing Business, Infrastructure, Economy, Quality of Life, Technology & Innovation, Education, Business Friendliness, Cost of Living and Access to Capital.

America’s top States for Business 2016 list has been announced with the top 10 (in order): Utah, Texas, Colorado, Minnesota, North Carolina, Washington, Michigan, Georgia, Iowa, and Florida. Compiled by CNBC, the rankings are based on 10 categories of competitiveness: Workforce, Cost of Doing Business, Infrastructure, Economy, Quality of Life, Technology & Innovation, Education, Business Friendliness, Cost of Living and Access to Capital.

However, CNBC’s ranking does not include some prime states for woodworking. Utilizing data from the Bureau of Labor Statistics, the following is a list of the top 10 woodworking states for furniture, cabinetry and millwork.

Residential furniture and cabinetry top 5 states are: California (with 1,419 shops), Florida (1,074), New York (684), Texas (663), and North Carolina (632). However, based on workforce size the ranking is as follows: North Carolina, California, Mississippi, Texas, and Ohio. Looking at just wood kitchen cabinet and countertop manufacturing facilities California comes in on top with 791 shops, followed by Florida (752), Texas (404), New York (345) and Georgia (341).

For office furniture, fixtures, and millwork shops California yet again ranks number one with 396 shops, followed by New York (279), Illinois (223), North Carolina (199) and Florida (195). Examining the 1,290 architectural woodwork and millwork shops New York ranks number one with 130 shops, followed closely by California (106), Florida (87), Illinois (83) and Texas (76).

Positive Signs for U.S. Housing Market

August 2016

Following the 2008 housing bubble burst, many thought the housing market would never fully recover. However, all signs are pointing towards continued growth and expansion within the U.S. housing market.

According to the U.S. Census Bureau construction spending during the first six months of this year amounted to $539.8 billion, a 6.2% increase over the same time period in 2015. During June 2016, construction spending was estimated at a seasonally adjusted annual rate of $1,133.5 billion where spending on residential construction was at a seasonally adjusted annual rate of $445.8 billion in June.

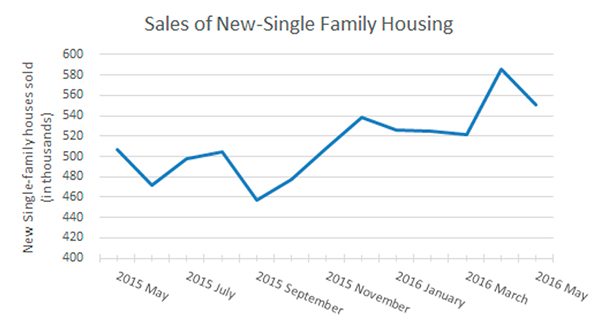

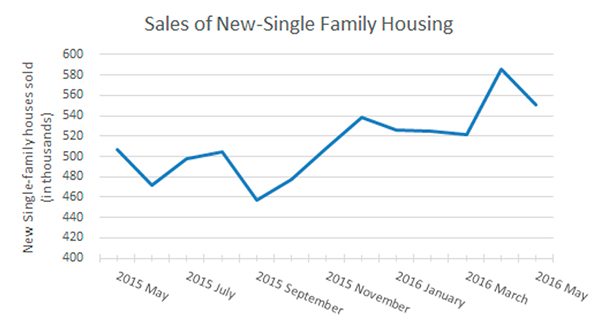

In addition to an increase in residential construction spending, sales of new single-family houses in June 2016 were at a seasonally adjusted annual rate of 592,000, 3.5% above the revised may rate of 572,000 and 25.4% above the June 2015 estimate of 472,000.

Lumber Production: US & Canada

August 2016

U.S lumber production through May totaled 13.450 billion board feet, a 2.5% increase from the January-May 2015 total according to the Western Wood Products Association. The South had the highest increase in production, up 3.0% over the same time frame in 2015.

In Canada, lumber production in May totaled of 2.378 billion board feet, a 9% increase above the May 2015 number. The year-to-date output is 9% ahead of the 2015 year-to-date pace. Quebec had the highest increase in production with a 16% increase over last year’s pace.

The U.S. Housing Market: Has it recovered?

July 2016

Nearly nine years later, the housing U.S. housing market is finally making its comeback. As a bright spot for the U.S economy, the housing market has led to increased employment, investment and overall economic growth. Although some areas such as sales of existing homes have been on a rapid rise other aspects of the housing market has yet to catch up to historical norms.

Nearly nine years later, the housing U.S. housing market is finally making its comeback. As a bright spot for the U.S economy, the housing market has led to increased employment, investment and overall economic growth. Although some areas such as sales of existing homes have been on a rapid rise other aspects of the housing market has yet to catch up to historical norms.

While May saw the highest level of sales for existing homes in the past nine years, the sales of new single-family houses decreased 6% to a seasonally adjusted annual rate of 551,000. Investment in private, residential construction has also been below historical norms while private spending on multi-family housing has surpassed pre-bubble era.

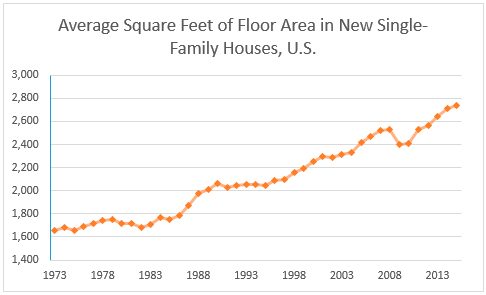

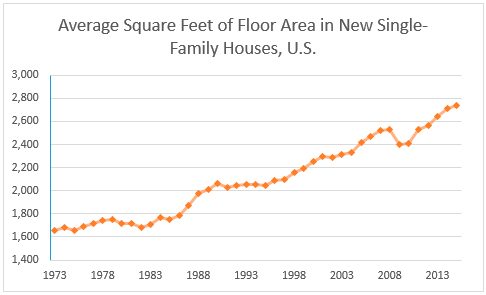

Another drastic change to the housing market seen over the past 15 years has been the overall size of homes. New single-family houses are now increasingly larger because builders have been focusing on larger homes with more amenities. About 31% of new constructed houses are over 3,000 square feet in 2015 compared to only 17% in 1999.

The U.S Housing market has made a slow recovery but it is not done yet. Signs are pointing to continued growth within the housing market at demand for housing increases as unemployment decreases and wages increase.

Increases in U.S. Industrial and Manufacturing Production

July 2016

U.S. industrial output rose in June at a seasonally adjusted rate of 0.6%, according to the Federal Reserve. The last time it jumped at that rate was in July 2015 and economists are forecasting another increase during the fourth quarter of 2016.

With signs pointing to economic growth within industrial production, manufacturing has also received positive growth on the Institute for Supply Management index (ISM). Activity was gauged at a 53.2* on the ISM index during June, a 1.9 increase compared to the previous month. This is the fourth consecutive month in which manufacturing production increased with notable growth in both orders and production and exports hitting the highest level since November 2014.

These encouraging signs indicate that the U.S. industrial and manufacturing industries are on the mend following recent periods of contraction.

For more information please visit ISM and The Federal Reserve

*On the Institute for Supply Management index a reading above 50 indicated that the factory activity is expanding and a reading below 50 signals contraction.

Canada: Investment in Residential Housing

July 2016

For the ninth consecutive year, investment in residential construction increased year-over year. In the first quarter, total investment in residential construction rose 2.1% to $26.1 billion compared with the same quarter in 2015. Higher investment in apartment and apartment-condominium building construction, up 21.2% to $4.1 billion, was responsible for the advance at the national level.

The latest data from April shows that new residential construction increased 8.4%, totaling $4.2 billion, compared to the same month in 2015. Continuing the trend, increase was driven by the higher investment levels in apartment and apartment-condominium building.

While investment within the past few months has increased at a fast rate, Canada Mortgage and Housing Corporation (CMHC) projects housing starts to slow down for the remainder of 2016 and going into 2017. Annual housing starts are expected to range from 181,000 units to 192,000 units in 2016 and from 172,000 units to 183,000 units in 2017. The forecast for the housing market will have strong regional variations due to slower growth in oil-producing provinces.

New Single-Family Housing Surge in Size and Sales

June 2016

Bigger is always better. For Americans, that seems to hold true in regards to housing. New single-family houses have increased in size over the last forty years according to the U.S. Census Bureau.

Homes are 61% larger than the median from 1975 and 11% larger than 2005. The median size of new single-family houses was 2,467 square feet last year. Not only are houses getting bigger but there is an addition of amenities, 93% of new houses had air conditioning compared to 46% in 1975. Almost 96% of new homes last year had at least two bathrooms compared to 60% forty years ago.

Homes are 61% larger than the median from 1975 and 11% larger than 2005. The median size of new single-family houses was 2,467 square feet last year. Not only are houses getting bigger but there is an addition of amenities, 93% of new houses had air conditioning compared to 46% in 1975. Almost 96% of new homes last year had at least two bathrooms compared to 60% forty years ago.

The housing market is continuing to gain strength due to steady job creation and low mortgage rates. According to the National Association of Realtors, the sales of existing homes increased for the second straight month in April. Along with the recent U.S. Census Bureau and the U.S. Department of Housing and Urban Development, sales of new single-family houses were at adjusted annual rate of 619,000 for April. This is a 16.6% increase from the Revised March rate and is 23.8% above the corresponding month last year. April 2016 is the strongest month in more than eight years.

Substantial Growth in the Wood Products Manufacturing Industry

June 2016

The overall economy grew for the 84th consecutive month and economic activity in the manufacturing sector expanded for the third consecutive month in May 2016 according to the latest Manufacturing ISM report. The May PMI registered at 51.3%, an increase of 0.5% from the April reading at 50.8%.

Out of 18 manufacturing industries, 12 industries reported overall growth with Wood Products leading the pack. The Wood Products manufacturing industry reported the most growth in production and new export orders but also stated significant growth in the new orders category. Wood Products additionally reported paying lower prices during the month of May.

These indications show that for the Wood Products manufacturing industry the market is improving progressively in both orders and pricing.

For more information, please visit: PRNEWSWIRE

Nearly nine years later, the housing U.S. housing market is finally making its comeback. As a bright spot for the U.S economy, the housing market has led to increased employment, investment and overall economic growth. Although some areas such as sales of existing homes have been on a rapid rise other aspects of the housing market has yet to catch up to historical norms.

Nearly nine years later, the housing U.S. housing market is finally making its comeback. As a bright spot for the U.S economy, the housing market has led to increased employment, investment and overall economic growth. Although some areas such as sales of existing homes have been on a rapid rise other aspects of the housing market has yet to catch up to historical norms. Homes are 61% larger than the median from 1975 and 11% larger than 2005. The median size of new single-family houses was 2,467 square feet last year. Not only are houses getting bigger but there is an addition of amenities, 93% of new houses had air conditioning compared to 46% in 1975. Almost 96% of new homes last year had at least two bathrooms compared to 60% forty years ago.

Homes are 61% larger than the median from 1975 and 11% larger than 2005. The median size of new single-family houses was 2,467 square feet last year. Not only are houses getting bigger but there is an addition of amenities, 93% of new houses had air conditioning compared to 46% in 1975. Almost 96% of new homes last year had at least two bathrooms compared to 60% forty years ago.