U.S. Economy & the Housing Market

August 2017

The U.S. economy shows no signs of slowing down.

A big recovery of GDP growth during the second quarter that was in large part fueled by consumer spending has brought back optimism. GDP growth was recorded at 2.6% in the 2nd quarter, a much better outlook than the revised 1.2% during the 1st quarter.

The Dow also reached a milestone after closing over 22,000 for the first time ever sustained by higher corporate profits and consumer spending.

“Earnings are growing and are growing faster than anybody thought. That alone will drive stock prices up,” says Brad McMillan, chief financial officer at Commonwealth Financial Network.

“We [also] see improving consumer confidence and business confidence. When investors are more confident when consumers are more confident when businesses are more confident, then typically you see stock prices rise,” McMillan adds.

Consumer confidence is up 3.8 points in July to June, reaching 121.1 (1985=100). At a 16 year high for consumer confidence! Overall consumers foresee the current economic expansion as continuing well into the second half of the year.

The increase in consumer confidence can be attributed to the strong job market. July saw the addition of 209,000 jobs, most notably jobs were added in the leisure and hospitality, education and health service, professional and business service and in manufacturing. Unemployment has also fallen to a 16 year low, a mere 4.3%. The tightening labor market has pushed wages up 2.5%; wages will continue to increase as the labor pool gets smaller and businesses will start competing for workers.

Added jobs and consumer confidence has also pushed the housing market forward. The sale of new, single-family homes rose 9.1% in June 2017 over June 2016. While existing home sales only increased 0.7% in June over the same month in 2016, this can be attributed to a low supply and price growth that is restraining budgets. The housing market will continue to grow despite facing constraints such as low inventory supply, fast pace price growth and the lack of land and labor.

U.S. Labor Market Roars Back to a 16-Year Record Low

July 2017

Exceeding expectations, the U.S. labor market has continued the trend of adding U.S. jobs to the market. The labor department released its June statistics and the numbers have surprised many. Total non-farm payroll employment has increased by 222,000 in June, 47,000 more jobs than expected by economists. “The payroll number is well above expectations,” said Jim O’Sullivan, chief United States economist at High-Frequency Economics.

The unemployment rate was little changed at 4.4%, this steadying of the unemployment rate can be attributed to an increase of individuals entering the U.S. workforce. However, with a shrinking available labor pool, companies are trying to ramp up their hiring for skilled workers. According to Career Builders 2017 Midyear Job Forecast, approximately 60% of employers are looking to bring in more workers, a 20% rise from a year ago.

The economic expansion is now entering its ninth year with the lowest unemployment rate in 16 years. Some feel it has reached full capacity. With a level that’s this low, unemployment has more room to go up than down. The U.S. has added jobs every month since October 2010, a record 81-month stretch that added 16 million workers and slowly repaired much of the damage from the 2007-09 recession. The unemployment rate touched a 16-year low and the number of job openings hit a record earlier this year.

U.S. Housing Inventory at a 20 Year Low

June 2017

Economic conditions in the U.S. have remained steady over the past year, giving many people the opportunity to purchase a home. A solid job market, average pay increases and historically low mortgage rates; people across the U.S. are looking to make that transition from renter to owner occupancy.

However, they face one major issue: trying to find a house.

The national supply of homes has reached a 20 year low and over the past year the steepest drop in supply has occurred among homes that are typically the most affordable for first-time buyers. April 2017 had a 5.7 month supply of homes a slight increase over March 2017 figure of 4.9 supply, however not nearly enough to meet the current demand.

Across different housing segments, starter and trade-up home inventory fell 8.7% and 7.9% year-over-year nationally, respectively. Meanwhile, the stock of premium homes remained relatively unchanged since last year, having fallen just 1.7%.

With a limited number of property listings amid solid demand, sellers have little reason to reduce asking prices. Housing not only has become difficult to find but also difficult to purchase due to rising housing costs. Starter homes median price has increase 8.3% during the first quarter of 2017 over 2016, while trade-up homes and premium home prices have risen 6.8% and 7.2%, respectively.

Among the factors that have fueled the decline in housing inventory are:

- Homeowners are staying in their houses longer, averaging 8 years. Nearly doubled since 2008

- Investors hold a large share of properties, utilizing them as rental properties. In 2016, investor owned housing increased to 35% of the market share, up 5% over the last 10 years average of 30%.

- Pace of income growth is lagging behind property values, affordability constrains mean rental demand will remain robust. Investors are reluctant to give up property.

While the long term solution for the housing market would be for builders to replenish the stock of new homes, they cannot seem to do it fast enough. Builders are completing homes at 65% of the rate they have historically. Builders are also faced with challenges such as the lack of ready-to build lots, costly regulations and a chronic shortage of skilled construction workers.

Despite the scant supply, U.S. home sales are expected to rise this year, economists say. Fueled by job growth, pay raises and still-low loan rates — and perhaps fearful of being left out as more homes are snapped up and prices rise further — many people are looking to buy.

Residential Furniture Sales on the Rise

June 2017

According to the most recent report by Smith and Leonard, residential furniture orders rose 12% in March compared to March 2016 and 17% higher than February 2017 orders. New orders were up 77% of the surveyed participants.

Although consumer confidence looks to be positive, “Converting that confidence to more activity seems to be the trick,” said Ken Smith, managing partner at Smith Leonard. “The March results of our survey were maybe a bit higher than we expected. Though most of what we had heard prior to the High Point Market had indicated that business had picked up. With over three-fourths of the participants reporting increases in orders, those expectations seemed to carry over into what we thought was a pretty good market.”

He added, “While the overall economic conditions in the U.S. continue to be a bit sluggish, the key factors continue to be somewhat strong. While housing is off a bit, the stock market has been very strong; inflation is not bad except for energy indexes and retail in general is positive, along with good consumer confidence. All of this together should continue to produce more furniture sales along the rest of the year.”

For more information, please visit Smith & Leonard

Construction Dilemmas

May 2017

Thirty-nine states added construction jobs between March 2016 and March 2017 while 17 states added construction jobs between February and March, according to an analysis by the Associated General Contractors of America of Labor Department data released today. Association officials noted that contractors in most states remain busy for now but worry about not being able to find enough workers to complete projects in the future.

California had the highest increase in construction jobs with 42,000 jobs added in the past year, followed by Florida with 36,500 jobs and Texas with 18,900 construction positions.

Construction jobs are projected to increase 6.5% by 2024 according to the U.S. Department of Labor Statistics due to an increase in residential and non-residential construction. The demand for single-family housing and multi-family housing has greatly increased due to a lack of inventory of available homes.

During March 2017, according to estimates released by the U.S. Census Bureau and the Department of Housing and Urban Development, there was a 5.8% increase of new home sales over February 2017. This was also a 15.6% increase over March 2016 estimates. This represents a supply of 5.2 months at the current sales rate.

While construction has continued to expand, the industry is now hitting a wall. The lack of skilled tradesmen has been sharply felt within the past few years. Most contractors are quoting longer completion times or passing up opportunities to big on new projects as a way of coping with shortages of available qualified workers.

According the study “Young Adults & the Construction Trades” by the National Association of Home Builders (NAHB) only 3% of individuals between the ages of 18-25 want to work in construction trades and 26% of individuals said they were uncertain of career paths. Of those 26% of respondents, only 18% said they would consider the construction industry if the pay was high enough. While 68% of the uncertain respondents would not consider the construction industry even if the pay was satisfactory said that the jobs were too physically demanding or that construction work was difficult.

The lack of skilled tradesmen have led to government intervention. North Idaho College has been awarded a $482,582 grant by the Idaho Department of Labor to train more than 200 workers in the wood products manufacturing industry and Michigan lawmakers have passed a budget that would offer increased funding for skilled trades.

Market Trends: Decorative Laminates

May 2017

Decorative laminates have steadily increased in use since 2010 as a cheap and durable alternative to traditional wood products. With rising housing starts and increases in commercial construction following the housing bubble burst in 2008, the demand for cost effective building materials increased and caused a shift towards decorative laminates.

According to the report “Decorative Laminates Market” by Markets and Markets ™, the decorative laminate market is estimated to grow from $6.71 billion in 2016 to $8 billion by 2021, at a CAGR of 3.5% from 2016-2021.

Based on end-use sector, the non-residential sector led the decorative laminates market in 2016 followed by the residential sector. The non-residential sector is forecasted to continue the lead, decorative laminates are being utilized in restaurants, laboratories, educational institutes, office furniture, hospital, hotels, and retail shops.

Decorative laminates are estimated to surpass 12 billion square meters by 2023 with thermoplastic films and saturated papers growing the fastest, according to the Fredonia Group.

Thermoplastic films which include polyvinyl chloride (PVC, also referred to as 3D laminates) and polyester (PET) films are growing in popularity due to long term durability and cost effectiveness. Over the years, changes in film composition allows for adding highly durable top coats and wear layers which increase scratch resistance and longevity of the finished product. There is also a vast array of design options ranging from wood grains, solids, stones, and abstract patters accompanied by various finishes such as high gloss, supper matte and deep emboss textures.

For residential consumers the design flexibility allows users to achieve exotic high end looks without consuming virgin wood or mineral resources that does not sacrifice look and feel of the space. For non-residential users 3D laminates are utilized for their distinct properties such as durability, high impact strength, cost effectiveness, variety, microbe-resistant, easy to maintain, customizable, easy installation, and lavish elegant looks. Non-residential uses can be seen in store fixtures, sculpted wall panels, office furniture products and specified healthcare applications.

Builder Confidence Reaches 12 Year High

April 2017

According to the National Association of Home Builders and Wells Fargo Housing Market Index (HMI) builder confidence in the market for newly build single-family homes jumped six points to a level of 71. This is the highest builder confidence reading since June 2005.

The HMI benefited from unseasonably warm weather at the start of 2017 which improved demand and construction conditions. While builders are extremely confident, there is expected to be some restraint moving forward. There are challenges that they continue to face including shortages of lots and labor, increasing mortgage rates and rising material prices.

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

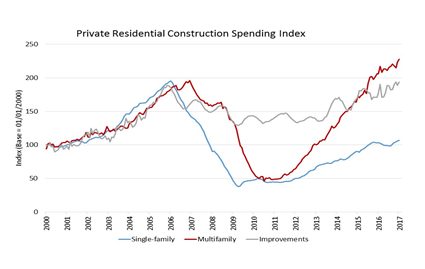

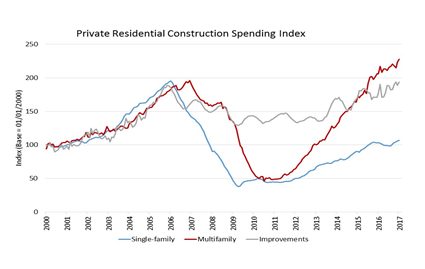

Residential Construction Spending Continues at Highest Level Since 2007

April 2017

Residential construction spending continues on its fifth consecutive month of growth. According to data released by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development private construction was at a seasonally adjusted rate of $917.3 billion for the month of February with $484.7 billion on residential construction. This is a 1.8% increase above the residential construction spending in January and up 6.4% from the same period one year earlier. This is the highest level since August 2007.

Multifamily construction spending also continued record breaking growth with a 2% increase to $64.5 billion over January 2017 and a 10.7% increase over February 2016. Single family construction spending also improved by 1.2%, continuing steady growth since October of 2016.

We Have Moved!

April 2017

Here We Grow Again…

Exciting things are happening at STF! It’s with great anticipation and pleasure to let you know that as of May 1, 2017, we will be moving into a bigger and better location. This 25,000 square foot facility with help us maintain the added design offerings, increase in our current inventory levels and bring more value added services to our current line. We will continue to update you as progress permits.

We have been operating out of Deerfield Beach since 2010 and your loyal business and support is the main reason we have grown so much over the last seven years. We look forward to continuing our relationship in the years to come with a bigger inventory, larger selection and more services.

Our business, including website, email, and telephones, will be fully operational during the moving process and you will not experience any changes or delays in service or shipping.

Please update your records with our new address:

12175 NW 39th Street

Coral Springs, FL 33065

All other information will remain the same:

Office: (954) 420-9553

Fax: (866) 783-4381

Email: Info@SynergyThermoFoils.com

www.SynergyThermoFoils.com

As a valued customer we thank you for taking the time to update your records. Please feel free to contact us at 954-420-9553 with any questions or concerns.

Residential Construction Spending Continues at Highest Level Since 2007

April 2017

Residential construction spending continues on its fifth consecutive month of growth. According to data released by the U.S. Census Bureau and the U.S. Department of Housing and Urban Development private construction was at a seasonally adjusted rate of $917.3 billion for the month of February with $484.7 billion on residential construction. This is a 1.8% increase above the residential construction spending in January and up 6.4% from the same period one year earlier. This is the highest level since August 2007.

Multifamily construction spending also continued record breaking growth with a 2% increase to $64.5 billion over January 2017 and a 10.7% increase over February 2016. Single family construction spending also improved by 1.2%, continuing steady growth since October of 2016.

Builder Confidence Reaches 12 Year High

April 2017

According to the National Association of Home Builders and Wells Fargo Housing Market Index (HMI) builder confidence in the market for newly build single-family homes jumped six points to a level of 71. This is the highest builder confidence reading since June 2005.

The HMI benefited from unseasonably warm weather at the start of 2017 which improved demand and construction conditions. While builders are extremely confident, there is expected to be some restraint moving forward. There are challenges that they continue to face including shortages of lots and labor, increasing mortgage rates and rising material prices.

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Cabinet Sales on the Rise

April 2017

According to participating members in the Kitchen Cabinet Manufacturers Association (KCMA)’s monthly Trend of Business Survey, cabinetry sales increased 4.3% in February 2017 compared to sales for February 2016. Stock cabinet sales increased 2.9%, semi-custom sales increased 6.6%, and custom sales increased 1.7% compared to the same period last year.

Survey participants include stock, semi-custom, and custom companies whose combined sales represent approximately 70 percent of the U.S. kitchen cabinet and bath vanity market. KCMA is the major trade association for kitchen cabinet and bath vanity manufacturers and key suppliers of goods and services to the industry. All major U.S. cabinet manufacturing companies belong to KCMA. Sixty-three percent of KCMA cabinet manufacturer members report sales below $10 million annually, reflecting the importance of small manufacturers in the industry. KCMA has been compiling and reporting industry sales data for more than forty years.