Home Improvement Retailers Report First Quarter Results

June 2016

The world’s two largest home improvement retailers have reported growth in the first quarter of this fiscal year.

Lowes, Mooresville, N.C., reported $884 million for the first quarter, a 31.4% increase over the same time period last year. Sales for the quarter increase 7.8% to $15.2 billion from $14.1 billion during the first quarter in 2015.

Home Depot, Atlanta, GA, reported first quarter net earnings $1.8 billion, an increase of 19% from the same period last year. Home Depot also reported sales of $22.8 billion for this quarter, a 9% increase from the first quarter during fiscal year 2015.

Demand for Single Family Construction

April 2016

The National Association of Realtors (NAR) released their first quarter Housing Opportunities and Market Experience survey which reveals that 85% of surveyed current homeowners and 75% of renters would purchase a single-family home in the next six months. When asked if they would purchase a home outside an urban area, 85 % of homeowners and 21% of renters answered that they would.

While there has been an increase in the demand for single-family homes, builder’s confidence for March has remained even with February. According to the National Association of Home Builders (NAHB), builder’s confidence for newly built single-family homes has been steady at a level of 58 on the National Associations of Home Builders/Wells Fargo Housing Market Index (HMI). The component gauging current sales conditions was level at 65 while sales expectations in the next six months dropped 3 points to 61 from February.

Please visit: The NAR Home Survey & NAHB

Cabinet and Furniture spur demand for High Pressure Laminates

April 2016

According to the Decorative Laminates study by the Freedonia Group, the demand for high-pressure laminates in the Unites States is projected to increase over the next four years. Decorative surfaces are in high demand for domestic manufacturing of cabinets, furniture, retail fixtures, and wall paneling. There is an expected 2.5% growth annually, reaching 11.6 billion square feet by 2020, approximately a $6.8 billion dollar increase. The cabinet market is projected to have the most gains in the use of decorative surfaces.

For more information, please visit: Freedonia Group

U.S Construction Spending in the Trillions of Dollars

March 2016

The U.S Census Bureau of the Department of Commerce announced U.S construction spending in January was estimated at a seasonally adjusted annual rate of $1.14 trillion. A 1.5% increase above the revised December estimate and 10.4% higher than the comparable month in 2015. Residential construction was nearly even at $433.2 billion and nonresidential totals increased 1% to $398.2 billion over December. Private construction spending rose 0.5% to $831.4 billion over December 2015.

Home Improvement Retailers Report Fourth Quarter 2015 Results

March 2016

The world’s two largest home improvement retailers reported fourth quarter 2015 increases in net earnings.

The Home Depot announced fourth quarter 2015 sales of $21 billion, an increase of 9.5% from the comparable period in 2014. Year-end sales were at $88.5 billion, up 6.4% from 2014 fiscal year. Annual earnings per diluted share in fiscal 2015 were $5.46 compared to $4.71 per diluted share in 2014, a 15.9% increase.

Lowe’s Companies reported net earnings of $11 million for the fourth quarter ending in January 29. Quarterly sales increased to $13.2 billion, a 5.6% increase. Fiscal year net earnings were $2.5 billion and annual net sales increase 5.1% to $59.1 billion.

Furniture Shipments Edge Upward

March 2016

According to a monthly survey of furniture manufacturers and distributors, U.S furniture factory orders have increased 1% in December 2015 over the same period in 2014. One-half of participants reported increases in December down slightly from the previous month. Overall in 2015, orders rose 4% over 2014.

The survey reported 47% of the participants had an increase in shipments of 5% over December 2014 increased shipments. Year-to-date shipments were up 6% over 2014.

For more information please visit: Smith Leonard

Cabinet Manufacturers Sales Up 8.5%

February 2016

According to the Kitchen Cabinet Manufacturers Association (KCMA) cabinet manufactures reported sales totaling $6.5 billion 2015, up 8.5% from 2014. Notably Masco’s cabinet segment sales reached $1.025 billion, an increase of 3% from 2014.

Additionally wood component sales within the RV industry leap 31%. Patrick Industries reported $248.7 million in sales up from $189.6 million during the same period in 2014.

MDF- Weyerhaeuser and Plum Creek Merges & Proteak begins MDF production

February 2016

Weyerhaeuser shareholders have approved the merger with Seattle based Plum Creek Timber Company. The pending merger was announced back in November 2015 is expected to be completed in early March.

Proteak MDF plant begins production in Tabasco, Mexico. Headquartered in Mexico City, Mexico, Proteak announced that the new plant’s annual capacity will be 280,000 m³.

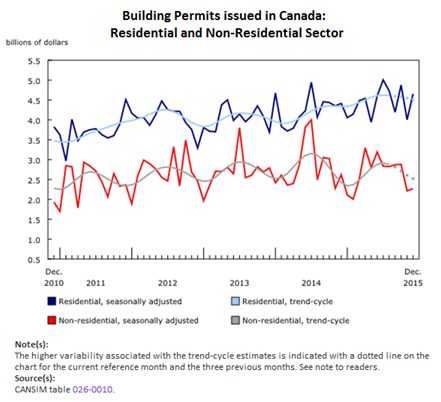

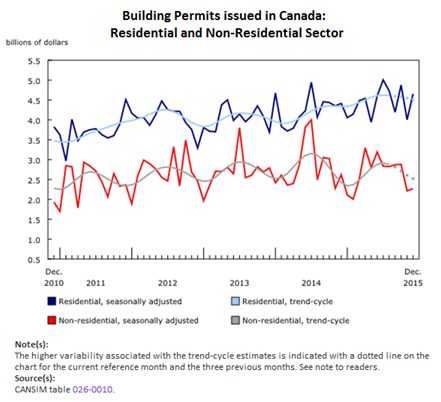

Canada: Building Permits on the Rise for December 2015

February 2016

Canadian building permits rose 11.3% to $6.9 billion in December. Higher construction intentions for multi-family housing lead the advance in building permits for December. The value of permits issued for multi-family housing rose to $2.3 billion in December, a 39.1% increase following a 33.8% decline in November. Quebec, Ontario and British Columbia lead the reports of higher construction intentions. The value of single-family housing decreased 0.1% from November, remaining at a stable $2.3 billion for the fourth consecutive month.

Overall for 2015 the value of building permits totaled $85.0 billion, unchanged from 2014. Residential building permits were up 4.4% from the previous year to $53.2 billion in 2015. Non-residential sector declined 6.3% from 2014 to $31.8 billion in 2015.

U.S: New Residential Sales in December 2015

February 2016

Sales of new single-family housing in December 2015 increased 10.8% to 544,000 over the revised November rates of 491,000 according to estimates released by the U.S. Census Bureau and the Department of Housing and Urban Development. This is a 9.9% increase from the December 2014 estimate of 495,000.

New Residential Sales in November 2015

January 2016

For November 2015, sales of new single-family houses were at a seasonally adjusted annual rate of 490,000 according to the U.S Census Bureau and the Department of Housing and Urban Development. This is a 9.1% increase from November 2014 and 4.3% above the revised October rate of 470,000.

U.S Construction Spending Continues to Increase

January 2016

According to the U.S Census Bureau of the Department of Commerce construction spending during November 2015 was at a seasonally adjusted rate of $1,122.5 billion, a 0.4% decrease from the revised October 2015 estimate of $1,127.0 billion and a 10.5% increase from the November 2014 estimate of $1,016.1 billion.

Private construction spending was at a seasonally adjusted rate of $828.2 billion with residential construction at $427.9 billion and nonresidential construction at $400.3 billion.

During the first 11 months of 2015, construction spending within the U.S amounted to $1,011.9 billion which is 10.7% above the same period in 2014.